Simplified Explanation of the Judgment

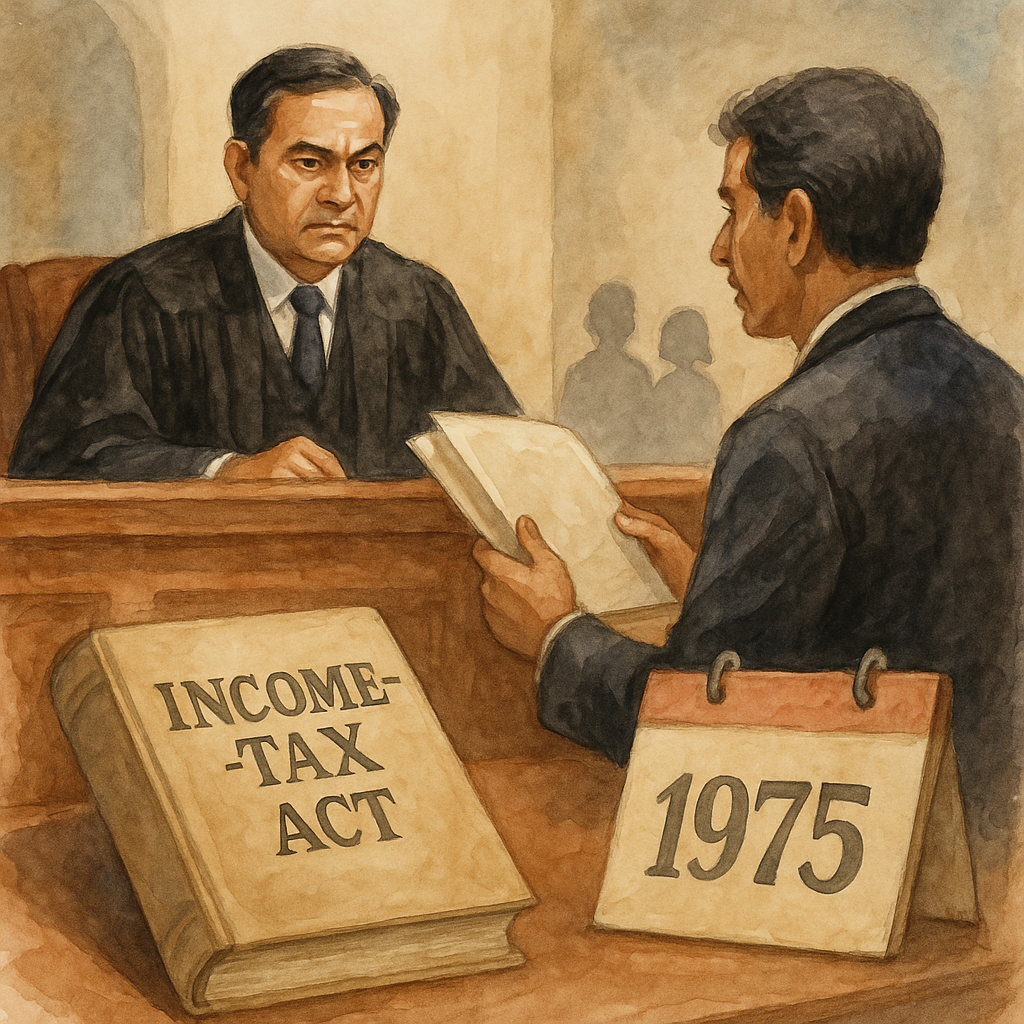

The Patna High Court has answered in the negative a reference under Section 256(1) of the Income Tax Act, 1961, holding that the income of two minor sons, including interest earned from their partnership share, could not be taxed in their father’s hands for the accounting period ending before 1 April 1976.

The case arose when the Income Tax Officer (ITO) assessed the income of a father for the Assessment Year (AY) 1976–77. The officer included in his total income the share and interest income of his two minor sons from a partnership firm, M/s Vijay Kumar Pradeep Kumar.

The minors had been admitted to the benefits of partnership under a deed dated 2 January 1975, with the firm’s accounting year ending on 31 December each year. For 1975, each minor earned around ₹19,000, inclusive of capital interest. The ITO added this amount under Section 64(1)(iii) of the Act (as amended in 1975) to the father’s taxable income.

Petitioner’s Argument:

- The amended Section 64(1)(iii), introduced by the Taxation Laws (Amendment) Act, 1975, came into force on 1 April 1976 and should not apply retrospectively to income earned in the accounting year 1975.

- Since the firm’s accounting year ended on 31 December 1975, the amendment did not cover that period.

Revenue’s Position:

- The amendment applied to the AY 1976–77, regardless of when the accounting year began or ended.

Tribunal’s Finding (Before Reference):

- The Tribunal upheld the ITO’s view, holding that the amendment applied to AY 1976–77 and thus the minors’ income for 1975 was taxable in the father’s hands.

High Court’s Analysis:

- Scope of Reference under Section 256:

- The High Court acts in an advisory jurisdiction and cannot reassess facts; it must answer only the legal question referred.

- Relevant Precedents:

- Keshav Mills Co. Ltd. v. CIT (1965) 2 SCR 908 – High Court cannot travel beyond facts found by the Tribunal.

- Premier Breweries Ltd. v. CIT (2015) 11 SCC 695 – In reference jurisdiction, the High Court cannot set aside Tribunal orders but only interpret law.

- Key Legal Principle:

- Following a 3-Judge Bench decision of the Patna High Court (2019) interpreting Kesoram Industries and Karimtharuvi Tea Estate Ltd., the Court reaffirmed that a taxing provision introducing a new liability applies prospectively unless expressly stated otherwise.

- Application to This Case:

- The amendment to Section 64(1)(iii) took effect from 1 April 1976.

- The relevant accounting year ended on 31 December 1975, before the amendment date.

- Therefore, the minors’ income for that period could not be taxed in the father’s hands.

Final Decision:

The High Court answered the reference in the negative — holding that the minors’ income (including interest) for the accounting year ending 31 December 1975 was not assessable in the father’s hands for AY 1976–77.

Significance or Implication of the Judgment

- Clarifies Scope of Section 64(1)(iii): Establishes that the 1975 amendment applies only prospectively from 1 April 1976.

- Protection Against Retrospective Taxation: Safeguards taxpayers from new liabilities being applied to past accounting periods without explicit legislative intent.

- Guidance for Revenue Authorities: Reinforces the principle that accounting year timelines are critical in determining tax applicability.

- Partnerships with Minors: Confirms that pre-amendment income of minors admitted to benefits of partnership cannot be clubbed with the parent’s income merely because the assessment year overlaps the amendment date.

Legal Issue(s) Decided and the Court’s Decision with Reasoning

- Whether the minors’ income for the accounting year ending 31 December 1975 is taxable in the father’s hands under amended Section 64(1)(iii)?

Decision: No. The amendment took effect from 1 April 1976 and could not be applied to the 1975 accounting year. - Whether the 1975 amendment applies retrospectively?

Decision: No. It applies prospectively from 1 April 1976, absent express retrospective provision.

Judgments Referred by Parties

- Badri Prasad & Ors. v. Commissioner of Income Tax, (1990) 185 ITR 307

judgments Relied Upon or Cited by Court

- Keshav Mills Co. Ltd. v. CIT, (1965) 2 SCR 908

- Rameshwar Prasad Bagla v. CIT, (1973) 3 SCC 575

- Premier Breweries Ltd. v. CIT, (2015) 11 SCC 695

- C.P. Sarathy Mudaliar v. CIT, (1966) 62 ITR 576 (SC)

- Kesoram Industries & Cotton Mills Ltd. v. Wealth Tax Commissioner, AIR 1966 SC 1370

- Karimtharuvi Tea Estate Ltd. v. State of Kerala, AIR 1966 SC 1385

Case Title

Alok Goenka v. Commissioner of Income Tax, Bihar, Patna

Case Number

Tax Case No. 126 of 1982

Citation(s)

Coram and Names of Judges

Hon’ble The Chief Justice Sanjay Karol

Hon’ble Mr. Justice S. Kumar

Names of Advocates and who they appeared for

- For the Petitioner: Mr. D. V. Pathy

- For the Respondent: Mr. Rishi Raj Sinha, Ms. Shilpi Keshri

Link to Judgment

https://patnahighcourt.gov.in/viewjudgment/NCMxMjYjMTk4MiMyI04=-K1eFCsu1ZB4=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.