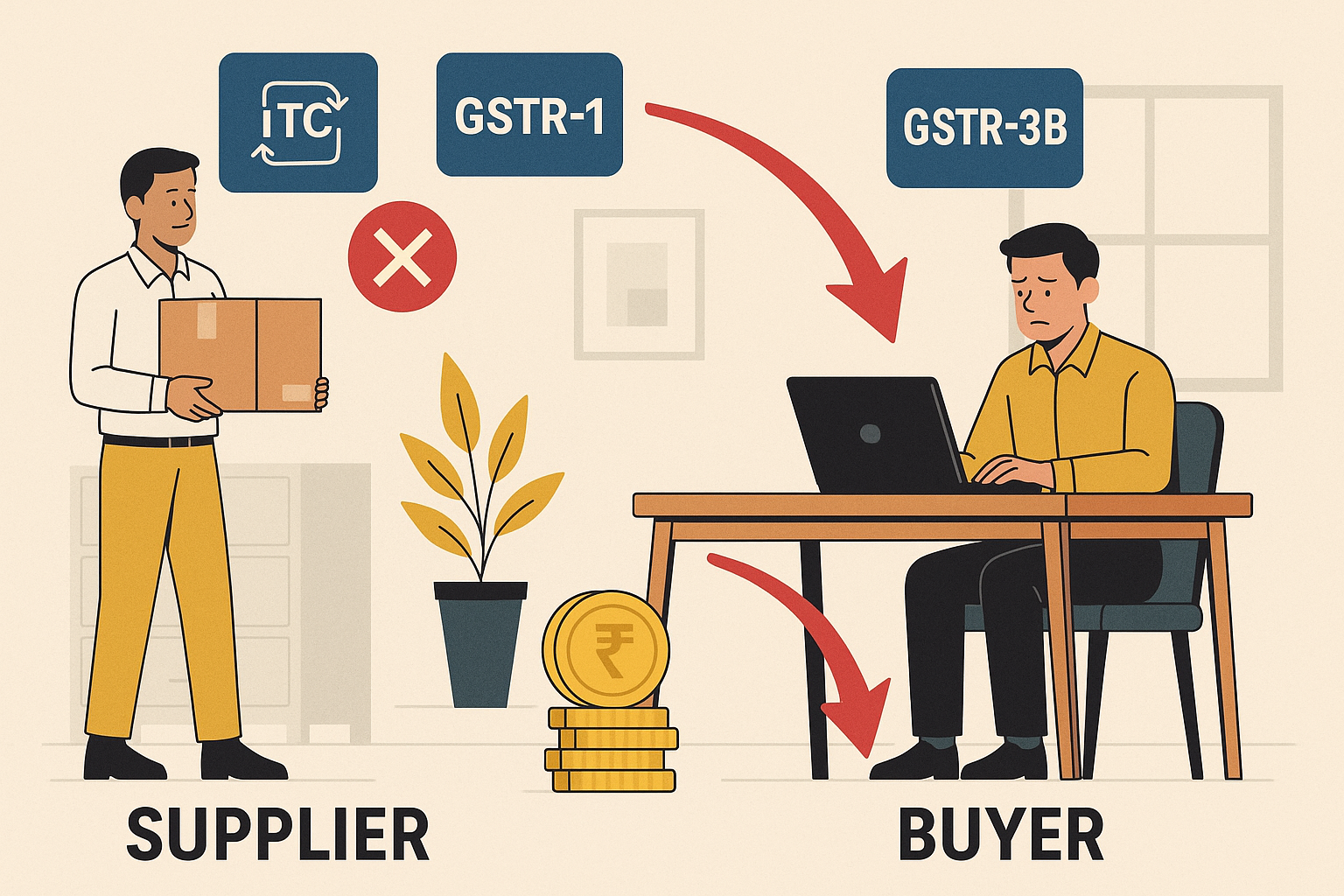

The petitioner, a registered dealer under GST, challenged a completed assessment for FY 2017–18 and the subsequent dismissal of its appeal. The crux of the dispute was a disallowance of input tax credit (ITC) because the supplier’s invoices were not fully visible in the purchaser’s GSTR-2A, even though the purchaser had claimed the ITC in GSTR-3B. The Patna High Court examined the Central Board of Indirect Taxes and Customs (CBIC) Circular F. No. 20001/2/2022-GST dated 27 December 2022 and concluded that the tax authority must follow the specific remedial procedure prescribed for the early years of GST (particularly FYs 2017–18 and 2018–19) when such GSTR-2A/GSTR-3B mismatches arise due to the supplier’s delayed or deficient compliances. Consequently, the Court set aside both the assessment order and the appellate order, and remanded the matter for a fresh consideration strictly in terms of the Circular.

The assessment order (for FY 2017–18) had determined that the petitioner’s ITC claim did not align with the figures reflected in GSTR-2A when the officer cross-verified the supplier’s returns. On that basis, a tax shortfall of approximately ₹34.69 lakh was computed. The petitioner’s case, however, was that the discrepancy existed primarily because the supplier had not timely or fully uploaded the invoices/returns on the compliance portal, despite the petitioner having paid the tax as part of consideration to the supplier and correctly claiming ITC in GSTR-3B.

Before the High Court, the petitioner relied squarely on the above CBIC Circular, which recognized the teething issues during the initial GST rollout, including delayed reporting by suppliers. The Circular contemplates, among other scenarios, cases where the supplier fails to file GSTR-1 for a given tax period but files GSTR-3B, causing the recipient’s GSTR-2A not to reflect the relevant supplies. For these specific situations, the Circular mandates following a stepwise verification protocol (para 4) instead of outright denying the recipient’s ITC merely because the auto-drafted GSTR-2A does not mirror the GSTR-3B claim. The Court accepted that the tax authority must apply this exact procedure for FY 2017–18 and 2018–19 cases, and therefore directed a fresh assessment in accordance with the Circular.

In simple terms, the High Court’s approach is this: when a recipient claims ITC for FY 2017–18 (or 2018–19) and there is a shortfall or mismatch in GSTR-2A due to the supplier’s reporting defaults, the officer cannot mechanically disallow the credit. Instead, the officer must test the claim on merits using the CBIC’s remedial framework—by verifying whether tax was indeed paid to the supplier, whether the supplies were actually received, and whether the supplier has since filed the relevant returns (e.g., GSTR-3B) covering those supplies. The Court specifically noted that the petitioner’s supplier had, in all probability, subsequently filed GSTR-3B and that the remand would allow the officer to verify this and recompute the liability accordingly. In effect, the Court ensured that a bona fide recipient is not punished solely because the supplier was late or inconsistent in uploading invoices, particularly in the nascent years of the GST regime.

Importantly, the Court set aside both the original assessment order (which had led to the tax demand based on the GSTR-2A shortfall) and the appellate order (which had affirmed that assessment). This clears the way for a de novo exercise, guided by the Circular’s para-4 procedure, to determine the admissible ITC and any residual tax liability, if at all. The ruling thus establishes a clear direction: where the CBIC has carved out transitional safeguards for early GST years, authorities must meaningfully apply them and cannot rely on a GSTR-2A mismatch alone to justify disallowance.

Significance or Implication of the Judgment

This decision is significant for taxpayers and administrators alike:

• For the general public and businesses in Bihar, particularly recipients of goods or services in 2017–18 and 2018–19, it reinforces that ITC cannot be denied automatically just because GSTR-2A did not reflect the full supplier-side data during those early years. If genuine transactions occurred and the recipient paid tax as part of the supplier invoice, officers must apply the CBIC’s remedial checks before drawing adverse conclusions.

• For the tax department, the ruling underscores the binding nature of the CBIC Circular for transitional years. It encourages a substantive, evidence-based review—verifying actual receipt of goods/services, tax payment to the supplier, and subsequent compliance (like GSTR-3B filing) by the supplier—before proceeding to disallow ITC. This helps align proceedings with fairness and prevents penalizing compliant recipients for another party’s initial-phase non-compliance.

• For both sides, the judgment reduces litigation risk by clarifying the correct procedural path. Remand-and-verify, rather than deny-by-default, is the governing principle for early-year mismatch cases.

Legal Issue(s) Decided and the Court’s Decision with Reasoning

• Whether ITC for FY 2017–18 can be denied solely due to a mismatch between the recipient’s GSTR-3B claims and the supplier-reflected figures in GSTR-2A.

— Court’s Decision: No, not solely for that reason in the early GST years; the officer must follow the CBIC Circular’s para-4 protocol for verification.

• Whether the CBIC Circular dated 27.12.2022 (F. No. 20001/2/2022-GST) is applicable to FY 2017–18 mismatch cases.

— Court’s Decision: Yes. The Circular explicitly addresses such scenarios for FYs 2017–18 and 2018–19 and prescribes how to handle differences arising from supplier-side filing issues.

• Whether the existing assessment and appellate orders should stand when the prescribed procedure under the Circular was not followed.

— Court’s Decision: No. Both orders were set aside and the matter was remanded for a fresh assessment compliant with the Circular.

Case Title

M/s Arcon Project Pvt. Ltd. v. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 18672 of 2024 (Patna High Court)

Coram and Names of Judges

Hon’ble the Chief Justice (K. Vinod Chandran) and Hon’ble Mr. Justice Partha Sarthy (Oral Judgment dated 11.12.2024)

Names of Advocates and who they appeared for

• For the petitioner: Ms. Archana Sinha @ Archana Shahi

• For the respondents: Government Pleader (07)

Link to Judgment

MTUjMTg2NzIjMjAyNCMxI04=-g3WW2KCE45A=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.