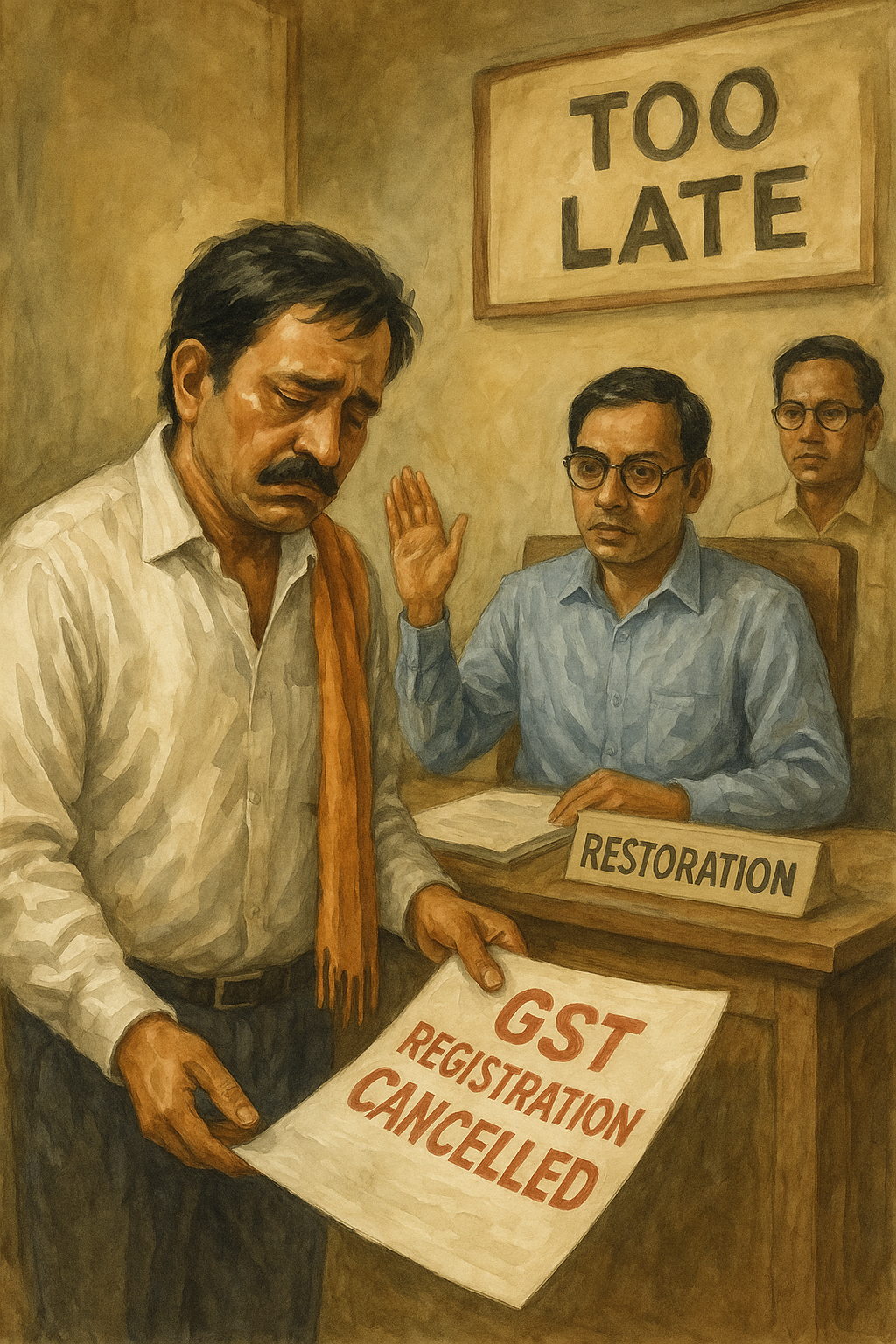

The Patna High Court dismissed a writ petition challenging cancellation of a GST registration after finding that the aggrieved taxpayer failed to use the statutory appeal in time—even after enjoying the Supreme Court’s COVID-19 limitation relaxations—and also ignored a specific “amnesty” window to restore registration. The Division Bench (Hon’ble the Chief Justice and Hon’ble Mr. Justice Partha Sarthy) held on 08 July 2024 that extraordinary writ jurisdiction under Article 226 cannot be used to bypass clear limitation rules and alternate remedies when the litigant has been indolent.

Simplified Explanation of the Judgment

A business (the petitioner) approached the Patna High Court against an order cancelling its GST registration. The cancellation order was issued on 17 July 2021 because the taxpayer had not filed returns for three consecutive tax periods. The petitioner did not dispute the fact of non-filing. It also did not claim that it had failed to receive the show-cause notice. In short, the basics—notice and violation (non-filing)—were not in controversy.

Under the Bihar Goods and Services Tax Act, 2017 (BGST Act), there is a clear appeal remedy. Section 107 allows an appeal to be filed within three months; further, if there is delay, another one month can be sought for condonation upon showing satisfactory reasons. In other words, a maximum of four months from the date of the original order is normally available to challenge a cancellation order.

However, the COVID-19 pandemic triggered a special situation. The Supreme Court, in Suo Motu Writ Petition (C) No. 3 of 2020 (In Re: Cognizance for Extension of Limitation), extended limitation across courts and tribunals. For this case, the saving of limitation ran from 15 March 2020 to 28 February 2022. The Supreme Court also permitted that appeals could be filed within ninety days starting from 01 March 2022. Applying this extension to the petitioner’s situation—where the cancellation order was dated 17 July 2021—the last permissible date to file an appeal became 30 May 2022 (with a further one-month condonation window thereafter if required).

Despite these relaxations, the petitioner filed the appeal only on 22 April 2024. This was nearly one year and eleven months after even the extended period expired. Such a long delay meant the appeal was clearly time-barred. Courts generally cannot condone such huge delays unless the statute allows it, and Section 107 fixes a strict outer limit for delay condonation (only one additional month). Therefore, the appellate remedy was lost due to the petitioner’s own inaction.

Parallelly, the State had introduced a special restoration window—described in the judgment as an “Amnesty Scheme” (Circular No. 3 of 2023)—covering the period from 31 March 2023 to 31 August 2023. Under this, registered dealers whose registrations were cancelled could get them restored upon paying all dues. The petitioner did not avail this limited-time opportunity either.

In writ jurisdiction, High Courts typically do not intervene when a party has an adequate alternate remedy, especially if that remedy was not pursued diligently. Here, the Court found no procedural unfairness—notice was given, violations were admitted by conduct (no contrary case was made), and two separate opportunities existed: an appeal under Section 107 (with COVID-19 extensions) and the Amnesty Scheme. Having ignored both, the petitioner couldn’t invoke Article 226 to cure its own delay. The Bench emphasized a core principle: “The law favours the diligent and not the indolent.” Consequently, the writ petition was dismissed.

In essence, the decision reinforces three practical points for taxpayers:

- If your registration is cancelled for non-filing of returns, promptly use the appellate route under Section 107 within the stipulated time (including the small condonation margin).

- Keep track of special windows/relief schemes designed to regularize defaults—missing them can be fatal.

- Writ jurisdiction is not a substitute for statutory remedies, especially when delay is extreme and unexplained.

Significance or Implication of the Judgment (For general public or government)

For taxpayers and small businesses, this case is a cautionary tale. Cancellation of GST registration has far-reaching consequences: it disrupts supply chains, blocks input tax credit to counterparties, and impairs credibility with vendors and authorities. The judgment underscores that once cancellation happens, time limits for remedy are strict. Even extraordinary relaxations like the Supreme Court’s COVID-19 orders cannot help if you overshoot by nearly two years. The message is simple: act swiftly, keep compliance in order, and never assume courts will forgive long periods of inaction.

For the State/GST administration, the decision confirms that enforcement actions such as cancellation for sustained non-filing will withstand judicial scrutiny if due process (show-cause and reasoned order) is followed. It also validates the utility of amnesty or restoration schemes: the window is temporary, and its benefits cannot be claimed after it closes without strict compliance to scheme terms. Administrations can rely on this precedent to defend decisions where taxpayers try to bypass the statutory timelines via writ petitions.

Legal Issue(s) Decided and the Court’s Decision with reasoning

- Whether the High Court should exercise its writ jurisdiction under Article 226 to interfere with a GST registration cancellation when the statutory appeal under Section 107 (BGST Act) was available but filed grossly out of time.

• Court’s decision: No. The writ court declined interference because an adequate alternate remedy existed and was not pursued within limitation; even the Supreme Court’s COVID-19 extensions had lapsed long before the appeal was filed. - Whether the petitioner could rely on special relaxation or restoration measures to overcome the delay.

• Court’s decision: No. The petitioner failed to use the limited-time Amnesty Scheme (Circular No. 3 of 2023) available between 31.03.2023 and 31.08.2023 for restoring cancelled registrations upon clearing dues. The failure to utilise the scheme weighed against the petitioner. - Whether there was any procedural defect (such as non-receipt of show-cause notice or erroneous allegation of non-filing) that could justify writ interference.

• Court’s decision: No. The petitioner did not dispute receipt of show-cause notice nor claim that returns for the relevant three consecutive periods had actually been filed; thus no procedural unfairness or factual error was shown.

Judgments Relied Upon or Cited by Court

- In Re: Cognizance for Extension of Limitation, Suo Motu Writ Petition (C) No. 3 of 2020 — orders saving limitation from 15.03.2020 to 28.02.2022 and permitting appeals within 90 days from 01.03.2022 (as applied by the Court).

Case Title

Atul Kumar Singh @ Bhutan Singh v. Union of India & Ors. (Challenge to the cancellation of GST registration)

Case Number

Civil Writ Jurisdiction Case No. 10215 of 2024

Coram and Names of Judges

Hon’ble the Chief Justice; Hon’ble Mr. Justice Partha Sarthy — Oral Judgment dated 08-07-2024

Names of Advocates and who they appeared for

For the petitioner: Mr. Dinesh Kumar, Advocate; Mr. Rajeev Kumar, Advocate

For the Union/CGST & CX: Dr. K.N. Singh, ASG; Mr. Anshuman Singh, Sr. SC, CGST & CX; Mr. Shivaditya Dhari Sinha, Advocate

For the State (BGST): Mr. Vivek Prasad, GP-7

Link to Judgment

MTUjMTAyMTUjMjAyNCMxI04=-774KhIxiuq4=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.