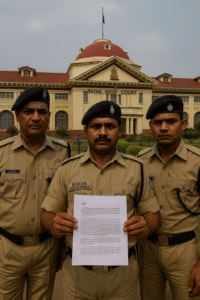

The Patna High Court has dismissed a writ petition filed by disappointed bidders who had participated in a tender floated by the Bihar State Food & Civil Supplies Corporation (BSFCSC) for selection of four “Transportation-cum-Handling & Delivery Contractors” for door-step delivery. The Division Bench comprising Hon’ble the Chief Justice and Hon’ble Mr. Justice Partha Sarthy delivered the oral judgment on 18 July 2024. The Court held that once the petitioners refused to accept the lower, negotiated rate and recused themselves from the financial negotiations, they fell out of the competitive race and could not subsequently question the technical eligibility of the successful bidders. The petition was dismissed.

Simplified Explanation of the Judgment

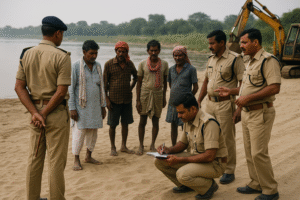

This case arises from a public procurement process for appointing four contractors to handle transport, handling, and door-step delivery of foodgrains for BSFCSC in Vaishali district. The tender (Notice Inviting Tender, or NIT) attracted multiple bidders, including the petitioners and several others. After scrutiny, seven bidders qualified in the technical stage. Negotiations were then held on price.

At the negotiation stage, all technically qualified bidders had initially quoted the same base rate. The tendering authority invited them to negotiate a lower workable rate in public interest. Four bidders (the eventual awardees) agreed to reduce their rate to ₹28 per quintal. The petitioners declined to match or better that negotiated figure. The authority therefore proceeded to award the four contracts to those who accepted the lower rate.

Only after losing out on price did the petitioners approach the High Court under Article 226, alleging that the successful bidders were not technically qualified and that the district-level tender committee had ignored multiple defects. They asserted, among other things, that (a) the bank statements of a successful bidder were not properly attested; (b) the GST returns reflected the name of a proprietary concern rather than the natural person; (c) there existed a business relationship in foodgrains which ought to have disqualified the bidder under a clause of the NIT; (d) the Unique Document Identification Number (UDIN) on the audit certificate was irregular; (e) vehicle fitness and agreement documents were deficient; and (f) there were discrepancies in a bidder’s addresses across documents.

The State and BSFCSC responded with records to show that: (i) everyone qualifying technically was called for negotiations; (ii) four bidders agreed to the reduced rate of ₹28 per quintal; (iii) the petitioners expressly refused to accept the negotiated rate; and (iv) all objections were examined by the District Manager in a detailed speaking order. The State also argued that the petitioners never objected to technical qualification at the time of negotiations; their objections surfaced only after they stood to lose on price.

The High Court agreed with the State authorities and found no illegality in the decision-making process. Key points from the Court’s analysis:

• First, on maintainability and locus: judicial review of tenders focuses on the decision-making process, not a re-appreciation of merits like an appellate court. Here, the petitioners refused the negotiated rate. Having opted out of the financial competition by choice, they cannot later attack the technical eligibility of those who remained and accepted a lower rate. In tender law, a bidder who is “out of the race” cannot challenge the award on hyper-technical grounds once the process has moved past them.

• Second, on each alleged “defect”:

— Bank Statement Attestation: The NIT clause only required attestation of the last six months’ bank statement by the Branch Manager. The authority found the relevant pages bore the branch seal/signature on the first and last page of a computer-generated statement. The Court held that the NIT did not insist on signature on every page; therefore, the objection failed.

— GST Return Name Mismatch: The Court accepted that in the case of a sole proprietorship, the proprietor and the proprietary concern are not distinct legal entities for taxation. Showing the concern’s name in returns did not disqualify the bidder.

— Alleged Foodgrains Business: The NIT clause barred relationship with rice/flour mills, fair price shops, or being “in the business of foodgrains (rice and wheat).” Evidence showed the transaction cited by the petitioners related to produce grown at home and not to rice/wheat trade; hence, no violation.

— UDIN/Audit Certificates: The audit certificate carried a valid UDIN issued by a Chartered Accountant; objection rejected.

— Vehicle Fitness/Agreements: The fitness certificates were found proper. In contrast, a vehicle agreement produced by one of the petitioners was itself not duly stamped.

— Address Discrepancy: The difference between a bidder’s ITR (present address) and Aadhaar (permanent address) was satisfactorily explained and not a ground for disqualification.

— Turnover Allegation: Records supported that the turnover declared was that of the bidder and not of a different concern, as alleged.

• Third, on comparatives cited by the petitioners: decisions relied on to argue that similar defects had earlier led to disqualification were found distinguishable. In one such case, the bank statement had been merely self-attested without proper authentication of the signatory as Branch Manager—factually different from the present case where official attestation existed.

Finally, the Court reiterated the settled principle: judicial review examines how a decision was arrived at—transparency, fairness, and adherence to the tender terms—not whether another view is possible. Since the petitioners themselves declined the lower negotiated rate and the competent authority had recorded reasons addressing each objection, the Court refused to interfere. The writ petition was dismissed, with the award and subsequent work orders left undisturbed.

Significance or Implication of the Judgment (For general public or government)

• For bidders: If you refuse a negotiated rate and withdraw from price talks, you effectively exit the competition. You cannot later challenge the technical eligibility of winners to upset the award. The timing of objections matters; raise them promptly during the process, not after you lose on price.

• For tendering authorities: This decision supports reasoned, record-based responses to technical objections and clarifies that attestation requirements must be read as written in the NIT—no more, no less. If the file shows due consideration of objections and a fair negotiation benefiting public exchequer (here, reducing the per-quintal rate), courts are unlikely to interfere.

• For public interest: Allowing negotiations that reduce rates can save public funds. The judgment emphasizes probity—authorities scrutinized each allegation in a speaking order—and rejects opportunistic litigation by non-successful bidders who had opted out of matching the lower rate.

Legal Issue(s) Decided and the Court’s Decision with reasoning

• Whether a bidder who declined the negotiated rate can challenge the award on technical grounds later

— Decision: No. By refusing to participate at the negotiated rate, the petitioners became non-contenders and lacked standing to assail the award later. The Court will not allow a bidder to challenge others after voluntarily exiting the financial competition.

• Whether alleged technical defects (bank statement attestation, GST name, UDIN, vehicle fitness, address mismatch, turnover) invalidated the winners’ qualification

— Decision: No. Each objection was examined and found compliant with the NIT or satisfactorily explained. The NIT did not require signatures on every page of a computer-generated bank statement; a sole proprietor and his proprietary firm are one for tax purposes; the foodgrains-business bar applied to rice/wheat trade and was not breached; UDIN and vehicle documents were proper; address differences were reasonably explained; turnover was correctly attributed.

• Scope of judicial review in tender matters

— Decision: Limited. The Court reviewed the process for fairness and adherence to tender conditions. It would not sit in appeal over technical assessments or substitute its view when the authority’s decision is reasoned and not arbitrary.

Judgments Referred by Parties

• Dheeraj Kumar v. State of Bihar, CWJC No. 6560 of 2024 (Patna High Court, 22.04.2024) — cited to argue that similar defects had led to disqualification in other tenders.

• Vikrant Kumar Gupta v. State of Bihar, CWJC No. 16897 of 2023 (Patna High Court, 21.03.2024) — relied upon for parity in technical disqualification standards.

Case Title

Rajesh Ranjan & Anr. v. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 2524 of 2024

Coram and Names of Judges

Hon’ble the Chief Justice (K. Vinod Chandran) and Hon’ble Mr. Justice Partha Sarthy

Names of Advocates and who they appeared for

• For the petitioners: Mr. Uday Kumar, Advocate

• For the respondents (State/BSFCSC): Mr. Vivek Prasad, GP-7

Link to Judgment

MTUjMjUyNCMyMDI0IzEjTg==-ESif6–ak1–u8SZg=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.