Simplified Explanation of the Judgment

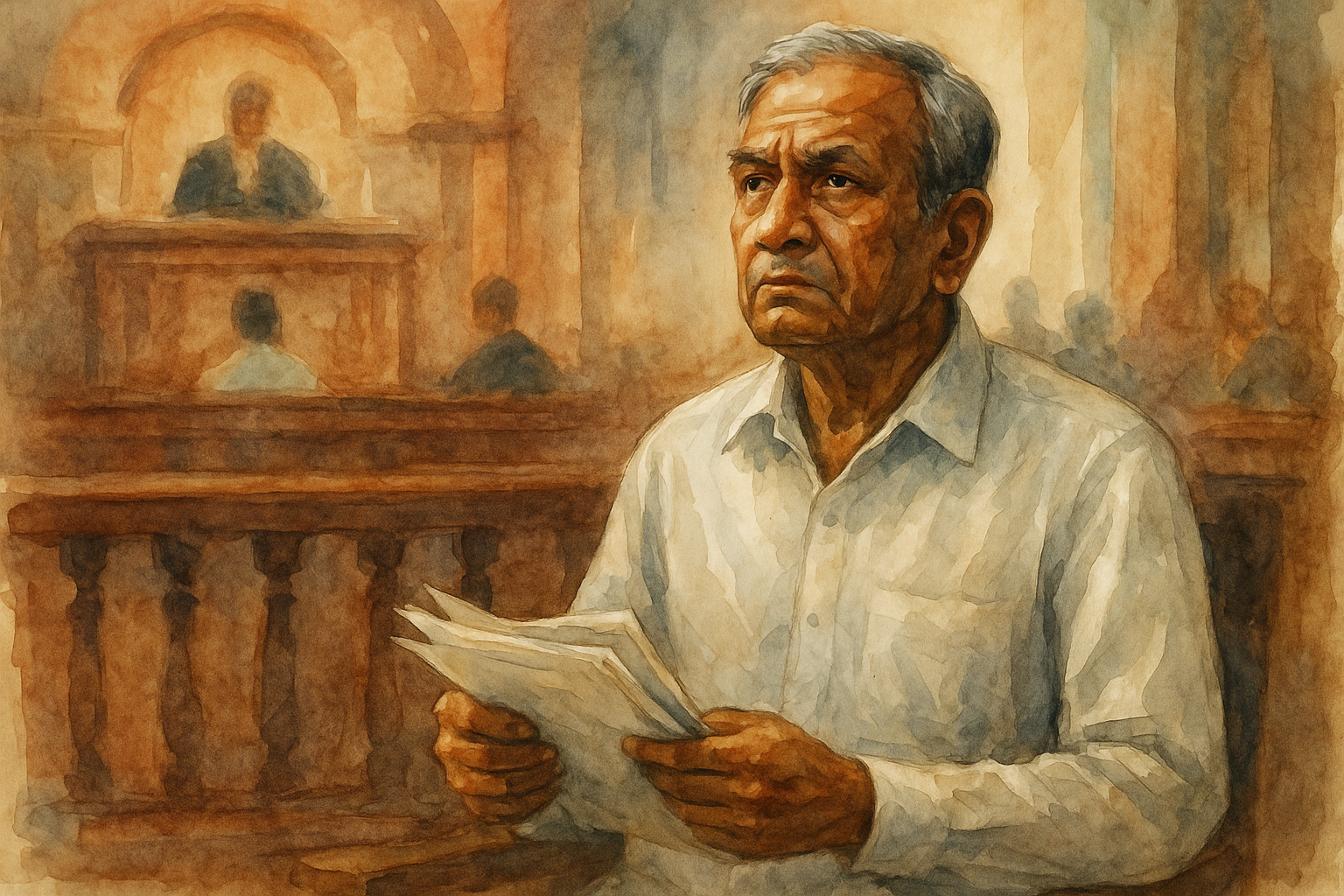

In this 2021 judgment, the Patna High Court examined an important issue relating to a retired government officer whose pension, gratuity, and leave encashment were withheld after his retirement. The Court held that the State Government cannot withhold or reduce a retired employee’s pension and retirement benefits without a valid departmental or judicial finding of guilt.

The petitioner, a retired Additional District Magistrate, challenged two orders of the General Administration Department (GAD), Government of Bihar:

- Memo No. 6836 (dated 29.04.2013) – withholding payment of gratuity and leave encashment till pending vigilance and other charges were decided.

- Memo No. 12081 (dated 22.07.2013) – permanently withholding 10% of his pension under Rule 139 of the Bihar Pension Rules, 1950, citing unsatisfactory service.

The petitioner argued that no departmental proceedings were pending against him at the time of retirement and no punishment had ever been imposed during his service. Therefore, the State had no authority to reduce his pension or stop his retirement dues.

The State contended that under Rules 139(a), (b), and (c) of the Bihar Pension Rules, the Government has the power to withhold pension in cases of unsatisfactory service or pending criminal proceedings. Since a vigilance case was filed against the officer in 2009, and some administrative charges were pending, the authorities believed they could retain part of his pension and withhold other benefits.

Court’s Analysis

The Court analyzed in detail Rules 43 and 139 of the Bihar Pension Rules, which deal with pension eligibility, withholding, and the rights of the Government.

- Rule 43(a) empowers the Government to withdraw pension if a pensioner is convicted of a serious crime or grave misconduct after retirement.

- Rule 43(b) allows the Government to withhold pension if, in a departmental or judicial proceeding, the pensioner is found guilty of misconduct or causing financial loss to the State.

- Rule 43(c) (inserted in 2012) provides that where such proceedings are pending at the time of retirement, provisional pension up to 90% should be paid.

- Rule 43(d) permits withholding of gratuity during the pendency of departmental or judicial proceedings.

- Rule 139 allows reduction in pension only if the service was “not thoroughly satisfactory.”

Applying these rules, the Court noted:

- The petitioner was never found guilty in any departmental or criminal proceeding.

- The departmental proceeding initiated during his service was never concluded.

- No punishment or adverse entry was recorded during his entire career.

- The vigilance case registered in 2009 was still pending, and mere pendency of a criminal case cannot justify permanent withholding of pension or gratuity.

Therefore, the Court held that the order reducing 10% pension under Rule 139(b) was illegal, as that rule could not be invoked without a finding of unsatisfactory service or guilt. It emphasized that pension and gratuity are not acts of charity; they are earned rights protected under the Constitution as property under Article 31(1).

Decision

The Court set aside both impugned orders — the one reducing pension and the one withholding gratuity and leave encashment — as unsustainable in law. The matter was remitted to the Principal Secretary, GAD, to reconsider the issue afresh in light of Rule 43 of the Bihar Pension Rules and to pass a fresh order within four months.

Significance or Implication of the Judgment

This ruling is significant for thousands of retired Bihar Government employees. It clarifies that:

- Retirement benefits are a vested legal right, not a discretionary favor.

- Pension cannot be reduced or withheld without a concluded departmental inquiry or criminal conviction.

- Pending vigilance cases or unproven allegations do not justify withholding gratuity or pension.

- The Government must comply strictly with Rule 43 if it wishes to suspend or recover any pension amount.

- Administrative authorities cannot invoke Rule 139 casually; “unsatisfactory service” must be backed by evidence from official records.

The judgment strengthens employee protection against arbitrary executive actions, promoting transparency and fairness in pension administration.

Legal Issues Decided and Court’s Reasoning

- Whether pension can be reduced under Rule 139(b) without a departmental proceeding or finding of guilt?

- Held: No. Pension cannot be reduced merely based on allegations or pending cases. The rule applies only when service is demonstrably unsatisfactory, supported by record.

- Whether gratuity and leave encashment can be withheld during pending vigilance cases without any rule?

- Held: No. Rule 43(d) allows such withholding only prospectively from 19.07.2012. Since the petitioner retired in 2010, it could not apply retrospectively.

- Whether mere pendency of a vigilance case can justify withholding pension or gratuity?

- Held: No. Without a finding of guilt or conclusion of proceedings, such withholding is illegal.

- Whether pension and gratuity are enforceable legal rights?

- Held: Yes. As per Deokinandan Prasad v. State of Bihar (1971) 2 SCC 330, pension is a constitutional property right under Article 31(1).

Judgments Referred by Parties

- Dr. Hira Lal v. State of Bihar & Ors., Civil Appeal Nos. 1677–1678 of 2020 (Supreme Court).

- Deokinandan Prasad v. State of Bihar, (1971) 2 SCC 330.

Judgments Relied Upon or Cited by the Court

- Deokinandan Prasad v. State of Bihar, (1971) 2 SCC 330 — Pension as property right.

- Dr. Hira Lal v. State of Bihar & Ors., (2020) — Government cannot withhold pension without due process.

Case Title

Retired Additional District Magistrate v. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 22973 of 2019

Citation(s)

2021(2) PLJR 879

Coram and Names of Judges

Hon’ble Mr. Justice Prabhat Kumar Jha

Names of Advocates and who they appeared for

- For the Petitioner: Mr. S.B.K. Mangalam, Advocate

- For the State: Mr. Sheo Shankar Prasad, SC-8

- For the Accountant General: Mr. Binod Kumar Labh, Advocate

Link to Judgment

MTUjMjI5NzMjMjAxOSMxI04=-DNgbPKV3hwM=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.