Simplified Explanation of the Judgment

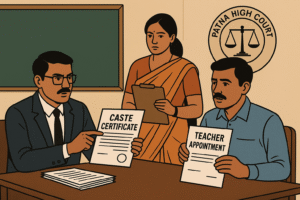

The Patna High Court, in a major decision clarifying the reach of the Prevention of Money Laundering Act, 2002 (PMLA), held that properties purchased and mortgaged before the alleged offence of money laundering cannot be treated as “proceeds of crime.” The Court therefore quashed the provisional attachment order issued by the Enforcement Directorate (ED) against certain properties mortgaged to HDFC Bank.

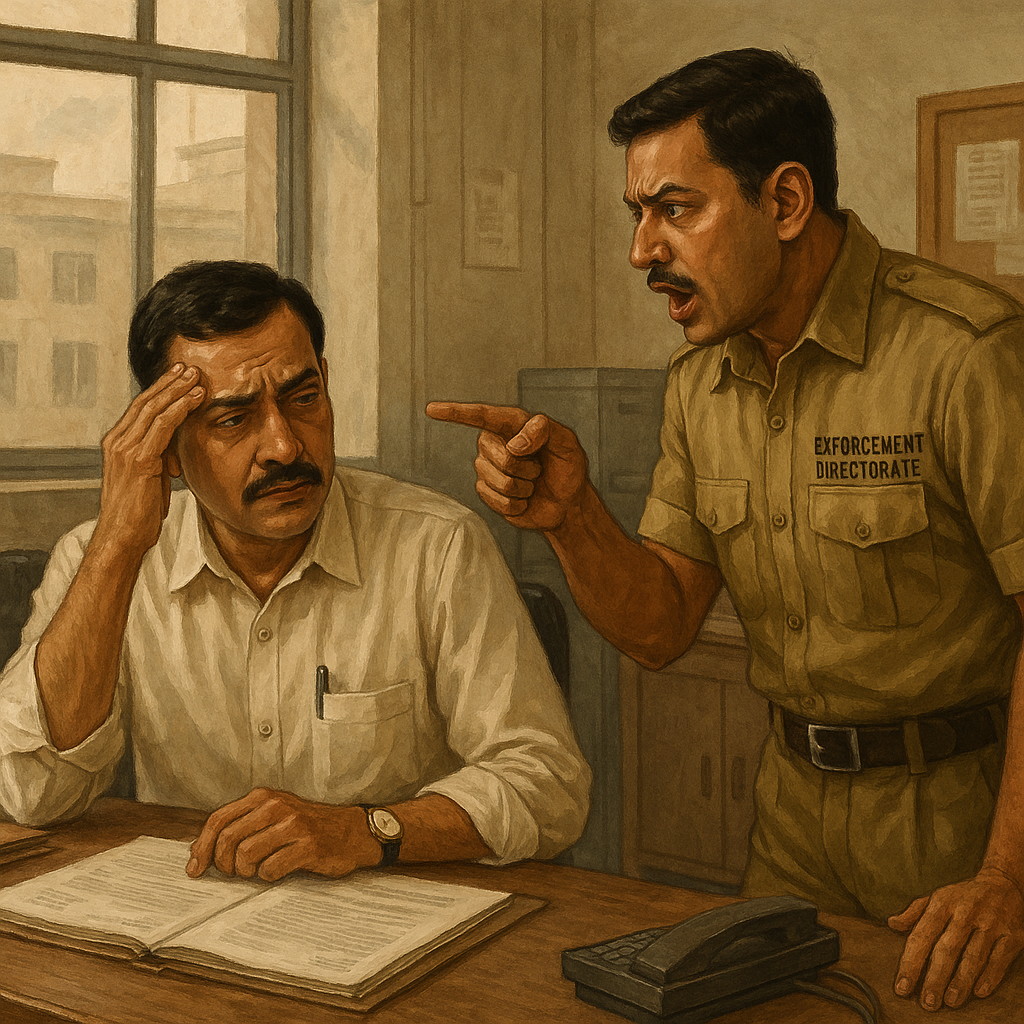

This case arose from two 2016 FIRs filed in Gaya concerning large cash transactions during the period of demonetisation. The Enforcement Directorate suspected that the proprietor of a business (respondent no. 5 in the case) was involved in laundering funds through accounts related to those FIRs. The ED provisionally attached three immovable properties and certain bank accounts, asserting that these represented “proceeds of crime” under the PMLA.

However, HDFC Bank, which had granted an overdraft facility against those properties much earlier, filed a writ petition under Articles 226 and 227 of the Constitution, arguing that the attached assets were lawfully mortgaged properties purchased years before the alleged money laundering took place. The Bank contended that it was a secured creditor with a superior legal claim under Section 31B of the Recovery of Debts and Bankruptcy Act, 1993 and Section 26E of the SARFAESI Act, 2002.

Court’s Key Findings

Hon’ble Mr. Justice Birendra Kumar examined the case closely and found serious procedural and legal flaws in the ED’s action.

- Definition of “Proceeds of Crime” (Section 2(1)(u) PMLA):

The Court noted that for a property to be treated as “proceeds of crime,” it must have been derived or obtained directly or indirectly from criminal activity related to a scheduled offence. Since the properties in question were acquired before any alleged crime and not purchased using tainted funds, they did not fit the legal definition. - Interpretation of “Value of Property”:

The Enforcement Directorate argued that even if the specific tainted property was unavailable, equivalent property of the accused could still be attached. The Court rejected this reasoning, holding that the “value of such property” refers only to assets derived or obtained from criminal activity, not unrelated legitimate assets. - Reliance on Other High Court Decisions:

The Court adopted the reasoning of the Punjab and Haryana High Court in Seema Garg v. Deputy Director, Directorate of Enforcement (2020 SCC OnLine P&H 738), which held that only assets directly linked to criminal proceeds could be attached. The Patna High Court specifically preferred this view over the Delhi High Court’s earlier single-judge decision in Deputy Director of Enforcement v. Axis Bank. - Natural Justice and Lack of “Reason to Believe”:

Under Section 5(1) of the PMLA, attachment can occur only if the authority has “reason to believe,” based on recorded material, that the property is linked to criminal proceeds. The Court found no such evidence or material in this case. The ED had not conducted any proper inquiry or provided notice to the bank or the property owner before attachment, thereby violating natural justice. - Interplay Between PMLA and SARFAESI:

The Court clarified that PMLA and SARFAESI Act operate in distinct legal fields. SARFAESI protects the rights of secured creditors against other debts or government dues, while PMLA deals with confiscation of tainted property. Therefore, HDFC Bank’s argument of priority under SARFAESI did not directly override PMLA — but since the attached properties were not “proceeds of crime” in the first place, the ED’s attachment itself was invalid. - Alternative Remedy Argument:

The ED argued that HDFC Bank should have approached the adjudicating authority under PMLA instead of filing a writ petition. The Court disagreed, observing that when an authority acts in defiance of statutory provisions or violates natural justice, the High Court can directly intervene under Article 226 — citing State of U.P. v. Mohd. Nooh (AIR 1958 SC 86) and CIT v. Chhabil Dass Agarwal ((2014) 1 SCC 603).

Final Decision

The Patna High Court quashed:

- The provisional attachment order dated 18.09.2017 (Annexure-3) issued under Section 5 of the PMLA, and

- The show-cause notice (Annexure-5) to the extent they covered the three immovable properties in Muzaffarpur:

- Flat No. GA, Madhusudan Garden

- Flat No. GB, Madhusudan Garden

- House at Kanhauli Vishundat, R.K. Puram Road No.2, Ward No.48

Thus, the properties were released from attachment, and the bank’s security interest remained protected.

Significance or Implication of the Judgment

This ruling has far-reaching implications for both the banking sector and law enforcement agencies:

- Protection for Secured Creditors: Banks holding mortgages over legitimate assets can rest assured that their rights cannot be arbitrarily overridden by ED actions unless the property itself is tainted.

- Limits on ED Powers: The decision reaffirms that ED must have a clear evidentiary basis and recorded reasons before labeling any property as proceeds of crime.

- Due Process Reinforced: The judgment reinforces natural justice — the affected party must be heard, and there must be material showing a connection between property and alleged laundering.

- Judicial Consistency: The High Court aligned Bihar’s position with other progressive rulings like Seema Garg v. ED, promoting uniformity in interpreting “proceeds of crime.”

- Guidance for Investigating Agencies: The ruling warns agencies to differentiate between tainted and legitimate assets to avoid overreach and unnecessary litigation.

Legal Issue(s) Decided and the Court’s Decision

- Whether property acquired before the alleged money laundering can be treated as “proceeds of crime”?

▪ No. Properties purchased and mortgaged before the alleged crime cannot be attached under PMLA. - Whether “value of such property” under Section 2(1)(u) includes unrelated legitimate property?

▪ No. It refers only to assets derived from criminal proceeds, not other lawful assets. - Whether attachment without evidence or notice is valid under Section 5(1) PMLA?

▪ No. Lack of recorded “reason to believe” and non-compliance with natural justice render the order invalid. - Does SARFAESI override PMLA where both claim over the same property?

▪ No direct conflict, but since the property was not “proceeds of crime,” PMLA attachment was void. - Is the writ maintainable despite alternative remedy under PMLA?

▪ Yes. When there’s violation of statutory provisions or natural justice, writ jurisdiction can be invoked.

Judgments Referred by Parties

- Union of India v. H.C. Goel, AIR 1964 SC 364 (for the “reason to believe” standard in administrative actions)

- Deputy Director of Enforcement v. Axis Bank (Delhi HC)

- Seema Garg v. Deputy Director, Directorate of Enforcement, 2020 SCC OnLine P&H 738

- CIT v. Chhabil Dass Agarwal, (2014) 1 SCC 603

- State of U.P. v. Mohd. Nooh, AIR 1958 SC 86

Judgments Relied Upon or Cited by the Court

- Seema Garg v. Deputy Director, Directorate of Enforcement, 2020 SCC OnLine P&H 738

- Abdullah Ali Balsharaf v. Directorate of Enforcement, (2019) 3 RCR (Criminal) 798 (Delhi HC)

- Aslam Mohammad Merchant v. Competent Authority, (2008) 14 SCC 186

- Ram & Shyam Company v. State of Haryana, (1985) 3 SCC 267

- CIT v. Chhabil Dass Agarwal, (2014) 1 SCC 603

Case Title

HDFC Bank Ltd. v. Government of India & Ors.

Case Number

Criminal Writ Jurisdiction Case No. 2398 of 2017

Citation(s)

2021(3) PLJR 12

Coram and Names of Judges

Hon’ble Mr. Justice Birendra Kumar

Names of Advocates and Appearance

- For the Petitioner (Bank): Mr. Sandeep Kumar, Mr. Dayanand Singh, Mr. Rohit Raj

- For the Respondents (Union & ED): Mr. A.B. Mathur, Central Government Counsel

- For the Intervener: Mr. Gautam Kejriwal, Mr. Alok Kumar Jha

Link to Judgment

MTYjMjM5OCMyMDE3IzEjTg==-durdKR0foRs=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.