The Patna High Court recently clarified the application of amended tax provisions, holding that the share of income earned by a minor from a partnership firm prior to the amendment of Section 64(1)(iii) of the Income Tax Act, 1961, cannot be retrospectively included in the parent’s income. This decision came in response to a reference made by the Income Tax Appellate Tribunal (ITAT), Patna Bench, under Section 256(1) of the Income Tax Act, 1961.

Simplified Explanation of the Judgment

This case revolved around whether the income earned by a minor child as a partner in a firm before 1 October 1975 could be included in the parent’s income for the assessment year 1976-77. The parent (assessee) challenged the Income Tax Officer’s (ITO) decision to include Rs. 32,031 — income earned by her minor son — in her total income.

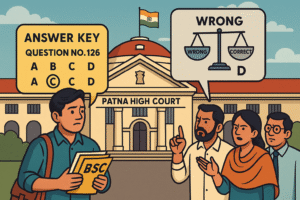

The key legal question was whether an amendment made to Section 64(1)(iii) of the Income Tax Act, which became effective from 1 October 1975, could be applied to income that had accrued earlier, specifically on 10 August 1975.

Initially, the ITO included the minor’s income, arguing that since the amendment was in force at the start of the assessment year (April 1, 1976), it applied to all income for that year, regardless of when it accrued. This view was upheld by the Appellate Assistant Commissioner and the ITAT.

However, the High Court disagreed. Citing a three-judge Bench decision of the same court, which relied on key Supreme Court judgments, the Bench ruled that tax laws introducing new liabilities cannot be applied retrospectively unless explicitly stated. Since the amendment came into effect on 1 October 1975 — after the income had already accrued — it could not apply to that income. Thus, the inclusion of the minor’s share in the parent’s assessment for 1976-77 was incorrect.

Significance or Implication of the Judgment

This judgment is significant for taxpayers and tax authorities alike. It reinforces the principle that tax laws should not be applied retrospectively unless clearly intended by the legislature. Individuals or businesses should not be taxed under provisions that did not exist at the time the income accrued.

This clarification offers legal certainty and safeguards against retrospective taxation, which can lead to unjust liabilities. The ruling is especially important for families where minors are admitted to the benefits of partnership in firms.

Legal Issue(s) Decided and the Court’s Decision

- Whether the income accrued to a minor from a partnership firm before 1 October 1975 could be taxed under the amended Section 64(1)(iii)?

- Court’s Decision: No. The amendment cannot apply retrospectively. The income accrued before the amendment date cannot be included in the parent’s income.

- Was the Appellate Tribunal correct in law in upholding such inclusion?

- Court’s Decision: No. The Tribunal’s decision was legally incorrect as it failed to account for the non-retrospective nature of the amendment.

Judgments Referred by Parties

- Badri Prasad & Ors. v. Commissioner of Income Tax, (1990) 185 ITR 307 (Pat)

Judgments Relied Upon or Cited by Court

- Kesoram Industries and Cotton Mills Ltd. v. Wealth Tax Commissioner (Central), Calcutta, AIR 1966 SC 1370

- Karimtharuvi Tea Estate Ltd v. State of Kerala, AIR 1966 SC 1385

- Keshav Mills Co. Ltd. v. CIT, (1965) 2 SCR 908

- Premier Breweries Ltd. v. CIT, (2015) 11 SCC 695

- C.P. Sarathy Mudaliar v. CIT, (1966) 62 ITR 576 (SC)

- Rameshwar Prasad Bagla v. CIT, (1973) 3 SCC 575

Case Title

Smt. Narmada Devi v. Commissioner of Income-tax, Bihar, Patna

Case Number

TAX Case No. 28 of 1986

Citation(s)- 2021(1) PLJR 618

Coram and Names of Judges

Hon’ble the Chief Justice Sanjay Karol and Hon’ble Mr. Justice S. Kumar

Names of Advocates and who they appeared for

- Mr. D. V. Pathy, Advocate – For the Petitioner

- Mr. Rishi Raj Sinha and Ms. Shilpi Keshri, Advocates – For the Respondent

Link to Judgment

NCMyOCMxOTg2IzIjTg==-i–am1–V–ak1–FvyrJfA=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.