Simplified Explanation of the Judgment

This case involved a dispute under the Bihar Value Added Tax Act, 2005 (BVAT Act). The petitioner, a proprietorship firm engaged in the automobile business in Siwan, challenged a tax demand notice issued on 17 December 2019. The notice arose out of assessment proceedings relating to the financial year 2012–13.

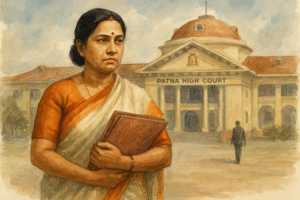

The petitioner’s primary grievance was that the demand notice had been issued without giving a fair opportunity of hearing, violating principles of natural justice. The petitioner also argued that by issuing this notice, the department had effectively curtailed its right to appeal under Section 72 of the BVAT Act. Consequently, the firm filed a writ petition (C.W.J.C. No. 6727 of 2020) before the Patna High Court under Article 226 of the Constitution, seeking quashing of the demand notice.

The State opposed the petition, arguing that:

- A writ court is not the proper forum to decide disputed questions of fact concerning tax liability.

- The BVAT Act provides a complete statutory remedy of appeal under Section 73(A), which the petitioner had not exhausted.

- The grievance about lack of natural justice could be raised and addressed before the appellate authority.

The Division Bench of Hon’ble the Chief Justice Sanjay Karol and Hon’ble Mr. Justice S. Kumar agreed with the State’s submissions. The Court emphasized that when a statute provides an alternative and efficacious remedy, the High Court should not interfere under writ jurisdiction unless there are extraordinary circumstances.

The Court, however, recognized that the petitioner’s bank account had already been attached, and the matter required an early resolution. Therefore, instead of dismissing the case outright, the Court facilitated a mutually agreeable arrangement between the parties:

- The petitioner was directed to appear before the appropriate appellate authority under Section 73(A) of the BVAT Act on or before 8 March 2021.

- If the petitioner filed the appeal within this period, the authority was directed to consider the application for interim relief within two weeks.

- The main proceedings were to be concluded positively by 31 March 2021, given that the case pertained to the 2012–13 assessment year.

- If any refund was found due to the petitioner, the competent authority would disburse it promptly within the statutory period.

- Proceedings could be conducted via digital mode due to the COVID-19 pandemic.

- Limitation issues would not obstruct the appeal, provided it was filed within the stipulated time.

- The petitioner retained liberty to challenge the authority’s order in accordance with law.

Thus, the writ petition was disposed of with these directions, leaving all issues open for consideration by the appellate authority.

Significance or Implication of the Judgment

- For taxpayers: This case underscores the importance of using the statutory appellate mechanism before approaching the High Court. Tax disputes involving factual issues must first be addressed before tax authorities, not in writ petitions.

- For government and revenue administration: The decision affirms that writ jurisdiction is not a substitute for the statutory framework under the BVAT Act. This protects the tax system from bypassing of established procedures.

- For the public: The judgment shows how courts balance taxpayer rights with administrative efficiency. While respecting statutory remedies, the Court ensured timelines for speedy disposal and protection against prolonged uncertainty.

Legal Issue(s) Decided and the Court’s Decision

- Whether a writ petition is maintainable against a tax demand when a statutory appeal remedy exists under the BVAT Act?

– Decision: No. The High Court declined to adjudicate disputed tax liability under writ jurisdiction, directing the petitioner to file an appeal. - Whether violation of natural justice can be raised directly in writ jurisdiction?

– Decision: Such issues can be more effectively raised before the appellate authority provided under the statute. - Relief granted by the Court:

– The Court disposed of the writ with directions enabling the petitioner to file an appeal, seek interim relief, and have the matter concluded by 31 March 2021.

Judgments Relied Upon or Cited by Court

- The Court relied upon the settled principle that writ petitions are not maintainable when an alternative statutory remedy is available, except in extraordinary circumstances.

Case Title

M/s Anand Automobiles vs. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 6727 of 2020

Citation(s)

2021(1)PLJR 743

Coram and Names of Judges

- Hon’ble the Chief Justice Sanjay Karol

- Hon’ble Mr. Justice S. Kumar (Judgment dated 19-02-2021)

Names of Advocates and who they appeared for

- For Petitioner: Mr. Sanjesh Prasad, Advocate

- For Respondents: Mr. Vikash Kumar, Standing Counsel 11

Link to Judgment

MTUjNjcyNyMyMDIwIzEjTg==-S85FPkPYkDk=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.