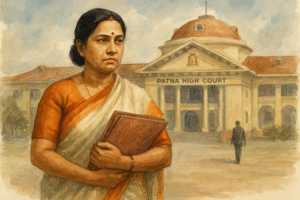

Simplified Explanation of the Judgment

In a combined judgment delivered on 24 February 2025, the Patna High Court allowed two writ petitions challenging the seizure of consignments of white peas and dried areca nuts by Customs Preventive authorities. The seizures, conducted under the Customs Act, 1962 and Foreign Trade (Development and Regulation) Act, 1992, were found legally unsustainable due to procedural lapses—specifically, the absence of a properly recorded “reason to believe” in the seizure memos.

Background of the First Case (CWJC No. 7085 of 2022):

The first petitioner was a registered GST dealer in Siliguri, dealing in tea, pulses, and foodgrains. He purchased 30,000 kg of white peas from Assam and sold 21,000 kg to a buyer in Kolkata. While transporting the goods, the truck was stopped and seized by the Customs Division in Kishanganj on 19 January 2021. The seizure was based on alleged violations of various sections of the Customs Act and the Foreign Trade Act.

Although the petitioner had all valid documents (invoice and e-way bill), the goods and truck were seized. Later, the vehicle was provisionally released, but the consignment of white peas was spoiled due to delays in storage and release.

Background of the Second Case (CWJC No. 7069 of 2022):

In the second writ, the petitioner was a GST-registered trader from Rajasthan engaged in areca nut trade. He bought 24,500 kg of dried Assamese areca nuts from local traders and farmers and transported them to Bikaner. The truck was stopped near the Galgalia Police Check Post on 7 June 2021, and customs officers, suspecting smuggling, seized the goods and the vehicle the next day. The seizure memo did not detail how the goods violated the law.

Both petitioners challenged the legality of the seizures and the conditions imposed for provisional release, including onerous bank guarantees.

Court’s Finding:

The High Court found that the seizure memos in both cases did not fulfill the statutory requirement of recording a “reason to believe” that the goods were liable for confiscation. Citing earlier judgments in Assam Supari Traders and Krishna Kali Traders, the court emphasized that merely citing statutory provisions without explaining the nature of violations was inadequate.

As such, the Court quashed the seizure memos dated 19.01.2021 and 08.06.2021.

However, the Court clarified that the quashing of seizure memos does not automatically invalidate the ongoing confiscation proceedings or the show cause notices, which had not been challenged in these petitions. Citing the Supreme Court decision in Union of India v. Om Sai Trading Company, the High Court held that the Customs Department retains the authority to proceed with investigations and adjudications under law.

Significance or Implication of the Judgment

This ruling is significant for traders and transporters operating in Bihar and the Northeast region. It reaffirms the constitutional right against arbitrary seizure by authorities and mandates strict adherence to procedural safeguards under the Customs Act.

The judgment provides much-needed clarity that seizure actions by enforcement agencies must be justified by recorded reasons. It helps ensure that legitimate traders are not harassed under mere suspicion without documented rationale. It also indirectly warns customs officers to follow due process or risk the annulment of their actions.

For the public, especially small traders and transporters, it serves as a protection against arbitrary state action and reinforces their rights under Articles 19 and 21 of the Constitution.

Legal Issue(s) Decided and the Court’s Decision with Reasoning

- Whether seizure of goods under Section 110 of the Customs Act requires recording of “reason to believe”?

- Decision: Yes. The Court held that a seizure memo must explicitly reflect the officer’s “reason to believe” that goods are liable to confiscation.

- Reasoning: Merely listing applicable sections without any factual basis or reasoning does not meet the legal requirement.

- Whether quashing of seizure memo invalidates confiscation proceedings automatically?

- Decision: No.

- Reasoning: As per the Supreme Court’s ruling in Om Sai Trading Company, Customs authorities may continue with adjudication and investigation, provided it complies with law.

- Whether the petitioner is entitled to cancellation of bonds and guarantees post spoilage or release?

- Decision: Not decided; matter left to be raised before the Adjudicating Authority.

- Reasoning: Petitioners did not challenge the show cause notices; thus, further directions were not warranted.

Judgments Referred by Parties

- Assam Supari Traders v. Union of India, 2024 SCC OnLine Pat 6401

- Krishna Kali Traders v. Union of India, 2024 SCC OnLine Pat 880

- M/s Ashoke Das and Another v. Union of India, CWJC No. 4918 of 2021, decided on 19.02.2025

Judgments Relied Upon or Cited by Court

- Union of India & Ors. v. M/s Om Sai Trading Company & Another, 2022 SCC OnLine SC 1419

Case Title

Jayesh Agarwal v. Union of India and Hanumanmal Surana v. Union of India (Connected Writs)

Case Number

CWJC Nos. 7085 and 7069 of 2022

Coram and Names of Judges

Hon’ble Mr. Justice Rajeev Ranjan Prasad

Hon’ble Mr. Justice Ramesh Chand Malviya

Names of Advocates and Who They Appeared For

- For Petitioners: Mr. Saket Gupta, Mr. Animesh Gupta, Mr. Shivam Gupta

- For Respondents: Hon’ble Dr. K.N. Singh, Sr. Advocate (ASG), Mr. Shivaditya Dhani Sinha

Link to Judgment

4e5dcdd6-a9b5-41e5-8389-34ef553b2422.pdf

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.