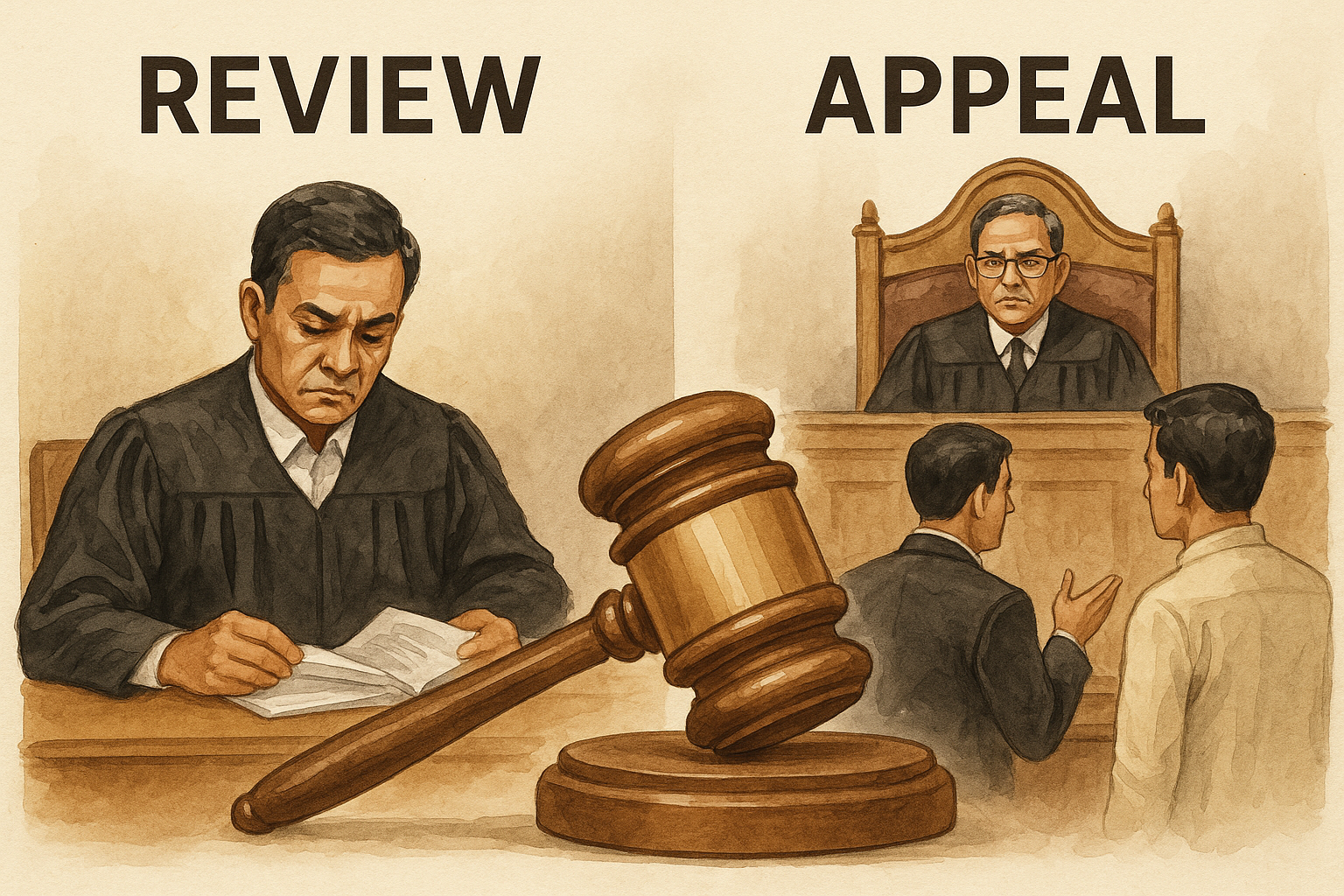

The Patna High Court (Division Bench) has clarified that a Debt Recovery Tribunal (DRT) cannot re-hear a borrower’s case under the guise of “review” in proceedings arising out of the SARFAESI Act. The Court allowed a Letters Patent Appeal (LPA No. 1114 of 2024) on 20 December 2024, set aside a Single Judge’s order, restored the Debt Recovery Appellate Tribunal’s (DRAT) decision, and reaffirmed that review is confined to correcting errors apparent on the face of the record or similar narrow grounds.

Simplified Explanation of the Judgment

This case arose from loan defaults by a borrower, against whom a bank initiated measures under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI). After the bank classified the accounts as non-performing assets (NPA), issued a demand notice, and took symbolic possession, the borrower approached the DRT by filing a securitisation application (S.A. No. 208 of 2018). The DRT dismissed that application on 20 March 2019 after hearing both sides and finding compliance with SARFAESI’s mandatory procedures. Instead of filing an appeal to the DRAT, the borrower sought a “review” before the DRT. Meanwhile, the bank proceeded with an auction sale, in which an auction purchaser emerged as the highest bidder; the sale certificate followed and was later registered.

The DRT then allowed the borrower’s review on 1 September 2021, essentially revisiting the merits by holding that certain materials had not been considered earlier and that the borrower’s representation under Section 13(3-A) of the SARFAESI Act had not been properly dealt with. On appeal, the DRAT set aside that review order on 11 November 2022, holding that “review” is a very limited jurisdiction and cannot become a vehicle for re-adjudication of the entire dispute. The borrower challenged the DRAT’s appellate order before the High Court via a writ petition, which a learned Single Judge allowed, relying heavily on a prior Division Bench decision (LPA No. 1029 of 2018) to conclude that review is maintainable. The auction purchaser (who had invested substantially and obtained licenses for a commercial establishment in the premises) then filed the present LPA challenging the Single Judge’s order.

Hearing the appeal, the Division Bench first accepted that a DRT does have a review power through the combined operation of: Section 17(7) of SARFAESI (which borrows procedure from the RDB Act), Section 22(2)(e) of the RDB Act (which confers powers analogous to a civil court, including review), and Rule 5-A of the Debts Recovery Tribunal (Procedure) Rules, 1993 (which permits correction of mistakes or errors apparent on the face of the record). However, the Court emphasised that this review jurisdiction is strictly limited and analogous to Order XLVII Rule 1 of the Code of Civil Procedure (CPC). In other words, review is available only for self-evident errors, clerical or typographical mistakes, or discovery of new and important evidence that, despite due diligence, could not be produced earlier. It is not a substitute for an appeal, nor a mechanism to re-hear the case on merits.

To explain the contours of review, the Division Bench drew guidance from the Supreme Court’s decision in State of West Bengal v. Kamal Sengupta, (2008) 8 SCC 612. That judgment, while rendered in the context of the Administrative Tribunals Act, lays down general principles that are in pari materia with the DRT’s review power via Section 22(2)(e) of the RDB Act. Among the key takeaways: (i) review is analogous to CPC review under Order XLVII Rule 1; (ii) only the grounds enumerated in Order XLVII Rule 1 are available; (iii) an error must be self-evident and not one discovered through long reasoning; (iv) a wrong or “possibly erroneous” order cannot be corrected in review; and (v) subsequent developments or judgments cannot form the basis for review.

Applying these principles, the High Court held that the DRT had impermissibly converted the review proceeding into a fresh hearing of S.A. No. 208 of 2018 by reassessing evidence and procedural compliance under Section 13(3-A). If the borrower believed the original dismissal order was erroneous on merits, the proper remedy was an appeal under Section 18 of SARFAESI, not a review. The DRAT, therefore, was correct in setting aside the DRT’s review order. The Single Judge’s decision to remand the matter (with an observation that review is maintainable) overlooked the narrow scope of review as settled by precedent; the Division Bench accordingly set aside the Single Judge’s order and restored the DRAT’s order.

The Court also noted the subsequent development that the bank’s Original Application (OA No. 1821 of 2019) under the RDB Act was allowed on 5 January 2024—another reason there was no scope for reopening the dispute through review. Importantly, by the time the writ petition was filed (January 2023), the auction sale had been concluded, the sale certificate issued, and the sale deed registered. The auction purchaser had invested and established a business on the property. While the judgment centers on the scope of review, it implicitly recognises the stability that auction sales under SARFAESI require and discourages collateral challenges through review when the statute provides an appellate remedy.

In sum, the High Court reaffirmed a simple rule: if you want to challenge a DRT order on merits, file an appeal. Do not try to re-litigate the entire case through a review petition meant only for correcting obvious errors or addressing genuinely new evidence. The LPA was allowed; the DRAT’s order was restored; and the Single Judge’s judgment was set aside.

Significance or Implication of the Judgment

For Borrowers and Banks: The decision underscores that review before DRT is not a shortcut to re-open merits. Borrowers must use the statutory appeal under Section 18 of SARFAESI for substantive grievances. Banks and auction purchasers gain certainty that concluded enforcement and sale processes will not be lightly unsettled through review.

For Auction Purchasers: The judgment reassures bona fide purchasers that courts will be slow to disturb concluded SARFAESI sales via an expansive reading of “review,” thereby protecting post-sale investments and commercial reliance interests.

For Government and Tribunals: The ruling promotes judicial discipline in DRTs by limiting review to CPC-like grounds, reducing delays and ensuring appeals, not reviews, are the primary vehicle for correcting legal or factual errors on merits.

Legal Issue(s) Decided and the Court’s Decision with reasoning

- Whether a DRT can use “review” to re-hear a SARFAESI matter on merits: No. Review is confined to errors apparent on the face of the record, clerical/typographical mistakes, or truly new evidence not available despite due diligence. Re-appreciation of facts or law belongs to an appeal under Section 18 SARFAESI.

- Whether the DRT’s review order in S.A. No. 208 of 2018 was valid: No. The DRT effectively conducted a rehearing and set aside measures by re-considering representations and materials, which exceeded review jurisdiction.

- Consequence for the Single Judge’s remand: Set aside. The Division Bench restored the DRAT’s order, reiterating the narrow scope of review.

- Impact of subsequent developments: The bank’s OA under the RDB Act was allowed on 05.01.2024; sale certificate and sale deed had already been issued/registered—further weighing against reopening the matter through review.

Judgments Referred by Parties

- Dilip Kumar v. Union of India & Ors., LPA No. 1029 of 2018, Patna High Court (27.09.2018).

Judgments Relied Upon or Cited by Court

- State of West Bengal v. Kamal Sengupta, (2008) 8 SCC 612 — principles governing review power parallel to CPC Order XLVII Rule 1.

- Dilip Kumar v. Union of India & Ors., LPA No. 1029 of 2018, Patna High Court — recognising that DRT has review power, but subject to CPC-like limits.

Case Title

Borrower v. Canara Bank & Others

Case Number

Letters Patent Appeal No. 1114 of 2024; arising out of CWJC No. 1556 of 2023; Review Application No. 06 of 2019 in S.A. No. 208 of 2018; Sale/OA references as noted.

Citation(s)

2025 (1) PLJR 548

Coram and Names of Judges

Hon’ble the Chief Justice K. Vinod Chandran

Hon’ble Mr. Justice Nani Tagia

Names of Advocates and who they appeared for

- For the Appellant (auction purchaser): Mr. P.K. Shahi, Senior Advocate; assisted by counsel on record.

- For the Bank (respondent): Mr. Gopal Kumar Singh; Mr. Ratnesh Nandan Sinha; Mr. Purusotam Prasad.

- For the Borrower (writ petitioner/respondent): Mr. D.K. Sinha, Senior Advocate.

- For the Union of India: Dr. K.N. Singh, ASG; Mr. Arun Kumar Satyamurthi, CGC.

Link to Judgment

MyMxMTE0IzIwMjQjMSNO-EV5wt8LQzrw=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.