Simplified Explanation of the Judgment

In a recent case before the Patna High Court, the petitioner challenged two key orders under the Bihar Goods and Services Tax (BGST) Act: the original tax determination order dated 08.02.2021 and the appellate order dated 19.03.2024. The central issue revolved around the violation of natural justice — specifically, the failure to provide a fair opportunity for the petitioner to respond to a show cause notice.

The petitioner, a business entity registered under GST, claimed they were unaware of the show cause notice issued by the tax authorities because it was only uploaded to the online GST portal and not physically or directly communicated. As a result, they could not respond or defend themselves. This led to an adverse tax order against them.

Subsequently, when the petitioner tried to appeal the tax order, the appellate authority dismissed the appeal on the technical ground that it was filed beyond the permissible time limit under Section 107 of the BGST Act.

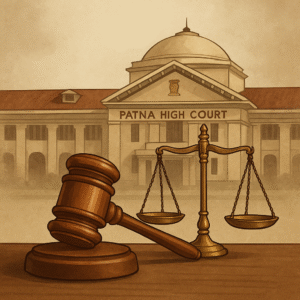

The Patna High Court took serious note of this procedural lapse. The bench, led by Hon’ble Mr. Justice P. B. Bajanthri and Hon’ble Mr. Justice Sunil Dutta Mishra, observed that uploading a notice on the portal without directly informing the taxpayer does not fulfill the requirement of fair procedure. They emphasized that the State cannot expect taxpayers to monitor the portal continuously for updates.

The Court referred to the Supreme Court’s decision in Madhyamam Broadcasting Ltd. v. Union of India, where it was held that fairness and reasonableness are essential in administrative procedures, especially those affecting civil rights like taxation.

Given this lapse in due process, the High Court held that the petitioner had been denied a fair opportunity to respond and that the tax and appellate orders were legally unsustainable.

The Court quashed both the original tax order and the appellate order, and directed the tax department to restart the proceedings from the stage of issuing the show cause notice. The petitioner was given six weeks to file a proper reply, and the tax authorities were instructed to complete the reassessment within two months thereafter.

Significance or Implication of the Judgment

This ruling has far-reaching implications for GST administration in Bihar and beyond. It reiterates that tax authorities must follow the principles of natural justice — including adequate notice and a genuine opportunity to be heard.

The judgment is particularly important for small businesses and distributors who may not regularly monitor the GST portal. It underscores the need for more robust communication practices by tax departments.

Additionally, it serves as a reminder to the government that digital compliance does not exempt them from basic fairness, especially when taxpayers’ financial liabilities are at stake.

Legal Issue(s) Decided and the Court’s Decision with Reasoning

- Was the show cause notice communicated in a fair and reasonable manner?

- Court’s Finding: No. Merely uploading the notice on the portal without informing the taxpayer directly violates the principles of natural justice.

- Could the appellate authority reject the appeal solely on delay without considering the fairness of the initial order?

- Court’s Finding: No. Since the initial tax order itself was passed without giving the petitioner an opportunity to respond, the dismissal of appeal on grounds of delay was unjustified.

- Should both the tax determination order and the appellate order be set aside?

- Court’s Finding: Yes. Both were quashed, and fresh proceedings were ordered to ensure fairness.

Judgments Referred by Parties

- Madhyamam Broadcasting Ltd. v. Union of India, (2023) 13 SCC 401.

Judgments Relied Upon or Cited by Court

- Madhyamam Broadcasting Ltd. v. Union of India, (2023) 13 SCC 401.

Case Title

M/s Maa Gaytri Distributor through Proprietor v. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 9658 of 2024

Coram and Names of Judges

Hon’ble Mr. Justice P. B. Bajanthri

Hon’ble Mr. Justice Sunil Dutta Mishra

Names of Advocates and Who They Appeared For

- For the Petitioner(s):

Mrs. Archana Sinha, Sr. Advocate

Mr. Alok Kumar @ Alok Kr Shahi, Advocate

Mr. Shubham Shankar, Advocate - For the Respondent(s):

Mr. Vivek Prasad, G.P.-7

Link to Judgment

26095b6c-a21e-4038-870a-c6f497273ef5.pdf

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.