The Patna High Court has issued an important order addressing the removal of excavated minor minerals left at a mining site after the expiry of a lease. The judgment balances two concerns: first, the contractor’s right to remove already-extracted stone chips/boulders, and second, the State’s interest in ensuring that statutory dues such as royalty and GST are safeguarded. The Court directed the authorities to allow lifting of all quantified broken stone material from two mining blocks in Nawada district within a strict timeline, while making it clear that royalty and any GST due must be paid within the same window.

At the outset, the Court recorded that the writ petitioner (a road construction contractor) sought a mandamus compelling the Mines and Geology Department and the district authorities to permit removal/transport of excavated stone chips and allied aggregates lying at a specified plot in Nawada, and for issuance of e-challans to facilitate such removal for timely completion of a National Highway project. The reliefs were framed around material admittedly present at site on the lease expiry date, as later quantified by joint inspection.

The background shows that two blocks were allotted in Nawada for supply of stone materials to government road projects. The lease for Block-3 (12.36 acres) expired on 30.12.2020; Block-6 (12.51 acres) expired on 14.01.2021. Covid-19 disruptions overlapped with these expiries. Post-expiry, an inspection on 02.06.2021 recorded 13,45,400 CFT of broken stones at the site, and the Assistant Director (Mines) granted a six-month window (04.06.2021 to 03.12.2021) to remove broken stone and machinery. A joint inspection on 10.08.2021 found 13,12,960.99 CFT then lying on site.

However, despite the Collector initially permitting removal of both machinery and broken material from 20.08.2021 to 19.02.2022, a subsequent letter dated 31.08.2021 allowed removal only of machinery/infrastructure (not the broken chips), and the Director (Mines) separately advised forfeiture of property left for more than six months after determination of the lease. These abrupt changes, issued even before the earlier extension period ended, became the core of the grievance.

On the State side, counsel voiced a practical concern: once the stock is lifted, the contractor might default on GST obligations. The State therefore sought protective directions to ensure tax compliance, noting that the petitioner is a registered GST assessee. The petitioner countered that it had already discharged royalty (arguing royalty is in the nature of a tax) and urged that removal should not be hindered, especially given the pandemic-related delays.

The Court surveyed constitutional entries and GST principles to frame the legal context. It noted the long-running debate on whether mining royalty is a tax—referencing India Cements, Kesoram, and the pending nine-Judge reference in Mineral Area Development Authority v. SAIL—but clarified that the State’s present concern was narrower: preventing revenue loss on supplies associated with the road contract. It also restated that GST applies to supplies of goods/services and that granting mineral rights for consideration (royalty) falls within the GST scheme unless excluded.

Crucially, the Court emphasized that, under the Bihar Minor Mineral Concession Rules, 1972, it is the Collector who is empowered to grant or renew leases and, with prior government approval, impose conditions. The Court found that actions by the Director/Assistant Director interfering with permissions—particularly the reversal of an earlier removal window without recorded reasons—were beyond their authority and reflected a colorable exercise of power. Such arbitrariness invites judicial correction under Article 226.

In the operative directions, the High Court mandated that the authorities must allow the petitioner to lift the entire quantified stock from Block-3 and Block-6 within two months. If any fresh determination of quantity is needed, it must be completed within one week in the presence of the petitioner’s representative. Simultaneously, the petitioner must ensure payment of royalty and any GST due within the same two-month period. The Court added that State Mines and State Tax officials should be more vigilant in future to prevent any removal without collection of royalty/tax.

In sum, the Court cut through administrative oscillation and restored a clear, time-bound mechanism: quantify, permit, lift, and pay dues. This enables public infrastructure to proceed while protecting the Treasury.

Significance or Implication of the Judgment (For general public or government)

This ruling is significant for government agencies, contractors, and the public relying on timely completion of road and infrastructure works:

- It affirms that once minor minerals are already extracted and duly quantified, post-expiry removal can be permitted, subject to statutory dues, rather than allowing stocks to decay or be forfeited arbitrarily. This prevents waste, protects project timelines, and reduces litigation.

- It underscores that administrative decisions must align with the statutory scheme: the Collector is the competent authority under the 1972 Rules, and higher-level departmental directions cannot casually override the Collector’s reasoned permissions without jurisdiction and recorded reasons.

- It highlights a workable compliance model for GST/royalty on mineral supplies: permitting removal while requiring payment of all dues within a fixed period, alongside agency-level vigilance and data sharing between Mines and State Tax departments.

- For the public, the decision helps minimize project delays—here, a National Highway stretch—by preventing policy flip-flops that stall material supply chains.

Legal Issue(s) Decided and the Court’s Decision with reasoning

- Whether authorities could refuse/withhold permission to remove already-extracted minor minerals after lease expiry despite earlier quantified stock and prior permission windows.

Decision: The Court directed that removal must be allowed within two months, with a one-week timeline for any fresh quantification. Administrative reversals without jurisdiction or reasons were deprecated as colorable exercise of power. - Whether Director/Assistant Director (Mines) could override or curtail the Collector’s permissions under the 1972 Rules.

Decision: No. The Collector is the statutory grant/renewal authority, and may impose conditions only with prior government approval; interference by other officers was beyond jurisdiction. - How to protect State revenue (GST/royalty) while permitting removal.

Decision: The petitioner must ensure payment of royalty and any GST due within two months; Mines and State Tax Departments must coordinate and remain vigilant to prevent removal without dues. - Whether arbitrary administrative action invites Article 226 intervention.

Decision: Yes. The Court relied on established Article 14/administrative law principles to correct arbitrary, mala fide, or non-speaking actions that derail lawful entitlements and public projects.

Judgments Referred by Parties

- India Cement Ltd. v. State of Tamil Nadu, 1990 AIR 85.

- State of West Bengal v. Kesoram Industries Ltd., AIR 2005 SC 1646.

- Bharat Sanchar Nigam Ltd. v. Union of India, (2006) 3 SCC 1.

- Gannon Dunkerley & Co. v. State of Rajasthan, (1993) 1 SCC 364.

Judgments Relied Upon or Cited by Court

- State of U.P. v. Mohd. Nooh, 1958 SC 86.

- Pratap Singh v. State of Punjab, AIR 1964 SC 72.

- Fashih Chaudhary v. D.G. Doordarshan, 1989 (1) SCC 189.

- E.P. Royappa v. State of Tamil Nadu, AIR 1974 SC 555.

- R.D. Shetty v. International Airport Authority, 1979 (3) SCC 489.

- Maneka Gandhi v. Union of India, 1978 (1) SCC 248 / 1981 (1) SCC 722 (as reflected).

- Ajay Hasia v. Khalid Mujib, 1981 (1) SCC 722.

- Shri Sitaram Sugar Co. Ltd. v. Union of India, 1990 (3) SCC 223.

- State (NCT of Delhi) v. Sanjeev @ Bittoo, 2005 (5) SCC 181.

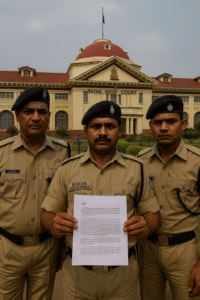

Case Title

M/s B.S.C.P.L Infrastructure Ltd. Vs. The State of Bihar

Case Number

Civil Writ Jurisdiction Case No. 12414 of 2023.

Coram and Names of Judges

Hon’ble Mr. Justice Purnendu Singh. (Oral Judgment dated 30-11-2023).

Names of Advocates and who they appeared for

- Mr. Umesh Prasad Singh, Senior Advocate — for the petitioner.

- Mr. Naresh Dikshit, Mr. Utrav Anand, Mr. Brij Bihari Tiwary — for the Mines Department.

- Mr. Vikash Kumar, SC-11, and Mr. Gyan Prakash Ojha, GA-7 — for the State.

Link to Judgment

MTUjMTI0MTQjMjAyMyMxI04=-tRKCxccgse4=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.