Simplified Explanation of the Judgment

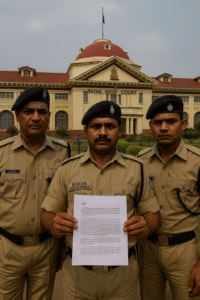

The Patna High Court recently allowed a writ petition filed by a coal supplier who had been blacklisted for three years and had their security deposit forfeited by the Bihar State Mining Corporation. The blacklisting was based on alleged violations of the supply contract’s terms, particularly concerning monthly supply limits.

The petitioner was supplying coal under an agreement that specified both an Annual Contracted Quantity (ACQ) and a Monthly Scheduled Quantity (MSQ), with MSQ being one-twelfth of the annual quota. The Corporation had accused the supplier of exceeding the MSQ in certain months and falling short in others, which allegedly amounted to a contract violation.

The core issue was whether the MSQ acted as a binding cap on monthly coal usage or whether it merely served as a guideline within the broader annual supply framework. The petitioner contended that coal supply was irregular—some months saw no deliveries, forcing them to shut down operations temporarily. In contrast, when supply resumed, the petitioner used more coal than the MSQ to compensate for prior shortfalls and maintain production.

The court had previously examined a nearly identical case—CWJC No. 1114 of 2024 (M/s Bhagwati Coke Industries Pvt. Ltd. v. State of Bihar & Ors.). In that ruling, the Court clarified that the actual obligation under the contract was to utilize the full ACQ over the course of the year. The MSQ did not serve as a strict limit per month, especially considering that the supply of coal itself depended on availability from coal companies.

The judges reiterated that under-utilization penalties only applied when the total annual quota (ACQ) was not lifted, not for monthly variations. They also noted that if the supplier could demonstrate proper utilization across the year, they couldn’t be penalized for exceeding monthly allotments in some months.

Applying that same reasoning in the current case, the Court found that blacklisting and forfeiture of the security deposit were unjustified. It ruled that unless the contract had expired due to the passage of time, it remained valid unless terminated properly by either party.

Thus, the High Court quashed the blacklisting and allowed the writ petition, protecting the supplier’s contractual and commercial rights.

Significance or Implication of the Judgment

This decision is highly significant for businesses involved in government supply contracts—especially those in sectors like coal, minerals, and energy. It clarifies that annual performance, not month-to-month fluctuations, should be the yardstick for compliance where annual quotas are mentioned.

The ruling also helps ensure fairness for suppliers who operate in industries affected by erratic public-sector supply chains. By protecting suppliers from unjust penalties and blacklisting due to circumstances beyond their control, the Court reaffirms the importance of reading contracts holistically and reasonably.

Government agencies are also reminded to enforce contracts in good faith and not to penalize suppliers based on rigid interpretations of procedural terms when the overall obligations are being met.

Legal Issue(s) Decided and the Court’s Decision with reasoning

- Was the blacklisting and forfeiture justified based on MSQ violations?

- No. The Court held that the contract’s main requirement was full annual utilization (ACQ), not strict monthly limits (MSQ). Monthly fluctuations were permissible.

- Did exceeding MSQ in some months amount to breach of contract?

- No. Since the total annual coal lifting matched the ACQ, and MSQ was not a cap but a schedule, there was no breach.

- Was the petitioner liable for any penalty?

- No. The petitioner’s actions were consistent with the contract terms and prior judicial interpretation.

- Did the earlier judgment apply to this case?

- Yes. The Court applied its decision in CWJC No. 1114 of 2024 directly to the facts of this case.

- What is the status of the agreement between the parties?

- It continues to be valid unless it has expired naturally or is rescinded under the agreement’s terms.

Judgments Referred by Parties

- CWJC No. 1114 of 2024 (M/s Bhagwati Coke Industries Pvt. Ltd. v. State of Bihar & Ors.)

Judgments Relied Upon or Cited by Court

- Same as above

Case Title

M/s SZ Traders v. State of Bihar & Ors.

Case Number

CWJC No. 4207 of 2024

Coram and Names of Judges

Hon’ble the Chief Justice K. Vinod Chandran

Hon’ble Mr. Justice Partha Sarthy

Names of Advocates and who they appeared for

Mr. S.D. Sanjay, Sr. Advocate – For the Petitioner

Mr. Siddharth Shankar Pandey, Mr. Mohit Agrawal, Mr. Vikash Khanna – For the Petitioner

Mr. Naresh Dikshit, Spl. P.P. Mines – For the Respondents

Ms. Kalpana, Mr. Arvind Ujjwal (SC-4), Mr. Sushil Kumar Mallick – For the Respondents

Link to Judgment

https://www.patnahighcourt.gov.in/ShowPdf/web/viewer.html?file=../../TEMP/be8ce872-a09e-4549-8a44-76100e7cce03.pdf&search=Blacklisting

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.