Simplified Explanation of the Judgment

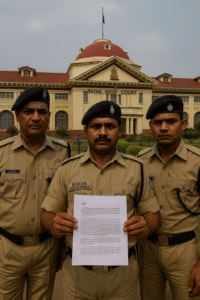

In this case, the Patna High Court dealt with a dispute between a construction company (petitioner) and the Bihar Commercial Tax Department (respondent). The conflict arose after the tax department imposed a penalty of nearly ₹14.85 lakh on the petitioner, accusing it of purchasing stone chips without paying the applicable entry tax for the financial year 2016–17.

The Assistant Commissioner of Commercial Taxes, Patliputra Circle, Patna, passed an order on 5 February 2019 under the Bihar Entry Tax Act read with Section 31(2) of the Bihar VAT Act. This order fastened a tax liability of ₹4.95 lakh and an additional penalty, totaling ₹14.85 lakh, based on the presumption that the petitioner had concealed purchases of stone chips. A demand notice was issued on 7 February 2019 directing recovery of this amount.

The petitioner challenged the order before the High Court, arguing that:

- It had not purchased any stone chips during the relevant financial year.

- Its books of account and records clearly showed no such transactions.

- Despite repeated requests, the department never disclosed the source of its information about the alleged purchases.

- The burden of proving tax evasion lies with the department, not the taxpayer.

- The penalty order was passed without granting a fair opportunity of hearing, violating the principles of natural justice.

The Court noted that the department only provided relevant documents to the petitioner during the pendency of the writ petition, not before passing the penalty order. Therefore, the petitioner was not given an adequate chance to respond or defend itself. Since the order imposed financial liability, which carries serious civil consequences, the lack of proper hearing rendered the order unsustainable.

Recognizing this violation, the Court quashed the impugned order of 5 February 2019 and the subsequent demand notice. However, to balance interests, the Court recorded the petitioner’s voluntary statement that it would deposit ₹1 lakh with the authorities to demonstrate bona fides. This deposit would be without prejudice to its rights and subject to adjustment when the case is reconsidered.

The High Court remanded the matter back to the Assistant Commissioner for fresh consideration. It directed:

- The petitioner must deposit ₹1 lakh by 5 April 2021.

- The petitioner should appear before the authority on that date with any additional material.

- Both parties must be given full opportunity to present evidence.

- The authority must decide the case on merits by 17 May 2021, adhering strictly to natural justice.

- Proceedings may be conducted digitally if necessary due to the COVID-19 pandemic.

- If the deposit exceeds the final determined liability, it must be refunded promptly.

Importantly, the Court clarified that it had not expressed any opinion on the merits of the tax liability, but quashed the penalty solely on the ground of violation of natural justice.

In effect, the Court emphasized that tax authorities cannot penalize an assessee without sharing evidence and giving a real opportunity to defend. Fair hearing remains central to the legitimacy of tax enforcement actions.

Significance or Implication of the Judgment

This judgment has significant implications for taxpayers and government authorities alike:

- For taxpayers: It reinforces the principle that no tax or penalty can be imposed without disclosure of evidence and a fair opportunity to contest allegations. It protects businesses from arbitrary or presumptive tax demands.

- For government authorities: It is a reminder that tax enforcement must follow due process. Authorities cannot bypass natural justice in the name of revenue collection. Orders passed without transparency and fair hearing are bound to be struck down.

- For governance: The judgment strengthens trust in judicial oversight, ensuring that tax administration is accountable and just.

Legal Issue(s) Decided and the Court’s Decision

- Whether the penalty order under the Bihar VAT and Entry Tax Acts was valid when passed without disclosing evidence or giving adequate hearing.

• Decision: No. The order was quashed for violation of principles of natural justice. - Whether the petitioner was liable to deposit any sum pending fresh adjudication.

• Decision: The Court accepted the petitioner’s voluntary offer to deposit ₹1 lakh as a token of bona fide compliance, without prejudice to final rights. - What directions should govern the remand proceedings.

• Decision: The authority must decide afresh by 17 May 2021 after full hearing, allowing both parties to present evidence, and refund any excess deposit.

Case Title

M/s Tata Projects Ltd. vs. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 7419 of 2019

Citation(s)

2021(2) PLJR 224

Coram and Names of Judges

- Hon’ble the Chief Justice Sanjay Karol

- Hon’ble Mr. Justice S. Kumar

Names of Advocates and who they appeared for

- For the petitioner: Mr. Anurag Saurav, Mr. Abhinav Alok, Mr. Priyajeet Pandey

- For the respondents: Mr. Vikash Kumar, SC 11

Link to Judgment

MTUjNzQxOSMyMDE5IzEjTg==-3aGLqZ5f2DM=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.