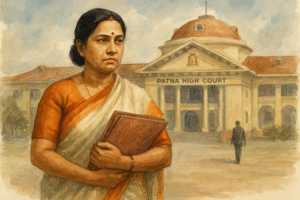

The Patna High Court in 2025 has once again clarified that the power to fix pay of non-teaching employees of State Universities in Bihar lies primarily with the statutory committee of the University and not with the Pay Verification Cell of the Education Department. In a writ petition filed by a widow of a deceased university professor, who was appointed on compassionate grounds in 2005 and later retired in 2019, the Court held that the State could not unilaterally modify her pay scale years after her retirement and then attempt to recover alleged “excess payment.” The Court set aside the State’s subsequent interference and directed that full retiral dues be paid to her on the basis of the original pay fixation made by the University. (Patna High Court, Oral Judgment dated 27-02-2025, Hon’ble Mr. Justice Harish Kumar)

Simplified Explanation of the Judgment

The case arose from a very typical situation in Bihar’s university system. The husband of the petitioner was a university professor who died in service on 09.02.2005. After his death, the petitioner, who held an M.A. degree, was given compassionate appointment in the University (under Tilka Manjhi Bhagalpur University) against a Class-III post in 2005. Her initial pay was fixed in the scale of ₹1200–1800 at that time, and like all university staff, her salary was revised from time to time under the 5th, 6th and later 7th Pay Revision frameworks applicable to University employees.

Later, based on State Government circulars that followed the Supreme Court judgment in State of Bihar & Anr. v. Sunny Prakash & Ors., (2013) 3 SCC 559, the University granted to non-teaching employees (including persons like the petitioner, appointed as clerical staff) the higher pay scale of ₹4000–6000 and also extended to them MACP/ACP benefits. Acting on those Government communications, the University issued its own office orders in 2014 and 2015, and the petitioner got the benefit of 1st MACP w.e.f. 14.04.2015. This became the basis for calculating her salary and, later, her pension.

She retired on 31.01.2019 on attaining the age of 62. On retirement, the University released only 90% of her pension, gratuity and leave encashment, even though there was no departmental or criminal case pending against her. She therefore filed a writ petition in 2021 before the Patna High Court seeking: (i) full pension, (ii) full gratuity, (iii) arrears of pay under 6th and 7th PRC, and (iv) interest for delay. During the pendency of the writ, the University did clear some amounts (90% arrears in 7th PRC and 90% leave encashment), but some core claims still remained unpaid.

While her writ was pending, a new problem arose. In 2023, the Director, Higher Education, Government of Bihar, issued Letter No. 2792 dated 22.07.2023 to the Pay Verification Cell directing it to issue an amended verified pay slip in her case. Acting on this, the Pay Verification Cell re-fixed her pay retrospectively and brought it down to the lower scale of ₹3050–4590 (as on 20.08.2005) and to ₹30,200/- as on 31.01.2019, instead of the University-approved higher scale of ₹4000–6000. On this basis, the University said that she had been “overpaid” to the extent of about ₹4,71,409/- and started processing recovery. This triggered the petitioner’s interlocutory application in the writ, challenging the State’s 2023 letter and the consequent pay slip.

The High Court examined, in detail, earlier letters of the Education Department, the University’s own statutory scheme, and above all, the consistent line of judgments of the Patna High Court itself, where it has been repeatedly held that the Pay Verification Cell (PVC) can raise audit objections but cannot unilaterally alter or annul a pay fixation made by the statutory committee of a University. The Court referred to its earlier judgment in Dr. Kedar Nath Pandey & Ors. v. Magadh University, 2015 (1) PLJR 574, where it was clearly stated that PVC’s role is supervisory and not determinative. The University has to ultimately decide, after hearing the affected employee. The Court also noted that this position was itself admitted by the State in its letter No. 1448 dated 24.07.2015.

Applying that settled position, the Court held that the 2023 direction of the Director, Higher Education, and the follow-up pay slip issued by the Pay Verification Cell were unsustainable and had to be quashed. The Court restored the petitioner’s position as if she had been validly appointed in the ₹4000–6000 scale, as earlier fixed by the University, and directed that all her admissible dues — including pension revision, gratuity, leave encashment and arrears under 7th PRC — be paid within three months. Very importantly, since the petitioner had already been retired for more than six years, the Court also said that any delay in payment would entitle her to 6% interest on the due amount.

In short, the Court told the State and the University: “You cannot reopen an employee’s pay scale long after retirement by using the Pay Verification Cell, especially when the scale was earlier fixed by the competent University authority in line with the Supreme Court’s Sunny Prakash ruling. You must pay what is due.”

Significance or Implication of the Judgment

This decision is significant for thousands of non-teaching and Class-III staff of Bihar’s State Universities whose pay was upgraded after the Supreme Court’s decision in Sunny Prakash and after the State’s 2014 notifications. Many of them face audit objections from the Pay Verification Cell years after they have been drawing salary or even after retirement. This judgment confirms that:

- The Pay Verification Cell is not a parallel pay-fixing authority.

- University statutory committees remain the primary decision-makers for pay fixation of their employees.

- Once pay has been validly fixed and acted upon, it cannot be casually reopened after a long delay, especially post-retirement.

- Recovery of so-called “excess” amounts paid on the basis of a valid University order will not be permitted unless fraud or misrepresentation is shown.

- Delayed retiral benefits will attract interest, particularly when the employee has already superannuated.

This is also a message to Government departments: internal financial controls cannot defeat judicially recognized rights of University employees flowing from Supreme Court-backed policy decisions.

Legal Issue(s) Decided and the Court’s Decision with Reasoning

- Whether the Pay Verification Cell could unilaterally reduce the petitioner’s pay scale from ₹4000–6000 to ₹3050–4590 on the basis of a 2023 direction of the Director, Higher Education, long after her retirement in 2019.

- Decision: No. The PVC can raise objections but cannot itself alter, annul, or downgrade a pay fixation validly made by the University’s statutory committee. The 22.07.2023 letter and the consequential verified pay slip were set aside.

- Reasoning: Consistent Patna High Court rulings, including Dr. Kedar Nath Pandey v. Magadh University, hold that PVC’s role is in the nature of audit; final decision must rest with the University. The State had itself accepted this position in its 2015 letter.

- Whether the petitioner, appointed on compassionate grounds, was entitled to the benefit of the higher scale (₹4000–6000) and MACP, as granted by the University pursuant to State circulars issued in compliance with Sunny Prakash.

- Decision: Yes. The petitioner was to be treated as appointed in the higher scale, as the University had done, and all benefits flowing therefrom (6th PRC, 7th PRC, MACP, pension, gratuity, leave encashment) must be recomputed accordingly.

- Reasoning: The State’s own notifications in 2014, issued to implement Sunny Prakash, directed Universities to extend ACP/MACP and upgraded scales to non-teaching staff like Library Assistants, Sorters, Routine Clerks, etc. The University’s 2014 and 2015 orders were in line with that. The State cannot go back on this after several years.

- Whether the University/State could withhold 10% of pension and gratuity when there was no departmental or criminal proceeding pending.

- Decision: No, such withholding was not justified; the Court directed payment of the full admissible amount.

- Reasoning: Withholding was not based on any pending proceeding but merely on an internal pay-verification objection raised belatedly; this cannot defeat retiral dues.

- Whether the petitioner would be entitled to interest for delayed payment of retiral benefits.

- Decision: Yes. Since the petitioner retired on 31.01.2019 and more than six years elapsed, any further delay would carry 6% interest.

- Reasoning: Long delay in disbursal of admitted monetary benefits to a superannuated employee is impermissible; interest is a compensatory measure.

Judgments Referred by Parties

- State of Bihar & Anr. v. Sunny Prakash & Ors., (2013) 3 SCC 559 — relied on to show that the State had committed to grant higher scales and ACP/MACP to non-teaching staff of Universities, and that such commitment was binding.

- Bimal Kumar Bimal v. State of Bihar & Ors., 2024 (6) BLJ 521 — cited to reinforce that PVC cannot undo University-sanctioned pay scales and that retrospective interference is impermissible.

Judgments Relied Upon or Cited by Court

- Dr. Kedar Nath Pandey & Ors. v. Magadh University & Ors., 2015 (1) PLJR 574 — for the proposition that Pay Verification Cell objections are only in the nature of audit and do not, by themselves, amend or annul University notifications.

- State of Bihar & Anr. v. Sunny Prakash & Ors., (2013) 3 SCC 559 — binding nature of the State’s undertaking to upgrade pay of non-teaching university staff.

- Indranath Jha v. State of Bihar & Ors., CWJC No. 4722 of 2020 (Patna High Court) — where, on an identical issue, the Court had directed adherence to pay fixation made by the University and ordered payment of all consequential dues.

Case Title

Smt. Kanchan Sah v. State of Bihar & Ors.

Case Number

Civil Writ Jurisdiction Case No. 19531 of 2021

Citation(s)

2025 (2) PLJR 90

Coram and Names of Judges

Hon’ble Mr. Justice Harish Kumar

Names of Advocates and who they appeared for

- For the petitioner: Senior Advocate (assisted by Advocate)

- For the State of Bihar: Counsel to GP-20

- For the University (T.M. Bhagalpur University): Advocate appearing for the University authorities

(Actual names in the judgment should not be used in the blog; use these designations only.)

Link to Judgment

MTUjMTk1MzEjMjAyMSMxI04=-rqVY–ak1–9yhQqw=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.