Simplified Explanation of the Judgment

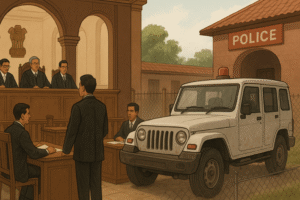

The Patna High Court, in a significant judgment dated 24 March 2021, modified its earlier order to permit the provisional release of a vehicle seized under the Bihar Prohibition and Excise Act, 2016, recognizing that keeping seized vehicles in police custody for years causes loss to both the owner and the State.

The case was filed by a woman whose pick-up van (Registration No. BR01GD 7018) had been seized by police in Sour Bazar P.S. Case No. 216 of 2018, registered for an alleged offence under Section 30(a) of the Excise Act.

The vehicle was lying in an open space near the police station since 2018 and had deteriorated over time. The petitioner, being the wife of a poor cart driver, requested that the vehicle be released without the requirement of a costly bank guarantee, as directed earlier.

The Division Bench, comprising Hon’ble the Chief Justice Sanjay Karol and Hon’ble Mr. Justice Rajeev Ranjan Prasad, allowed her plea in part, directing the authorities to revalue the vehicle and release it upon furnishing a surety bond equivalent to its present value, instead of a bank guarantee.

Background of the Case

In 2018, the petitioner’s pick-up van was seized by the Saharsa Police for alleged involvement in transportation of prohibited liquor. The petitioner filed CWJC No. 12014 of 2018 seeking release of the vehicle, and the High Court had earlier permitted provisional release on the condition of producing ownership documents, two sureties, and a bank guarantee equal to the insured value of the vehicle.

However, as the insurance policy was third-party only, it did not mention any vehicle valuation. The Motor Vehicle Inspector (MVI) had later assessed the vehicle’s value at ₹2,00,000 in 2019.

By the time the review application (Civil Review No. 397 of 2019) was filed, nearly three years had passed, and the vehicle was rusting in an open area, no longer roadworthy. The petitioner requested modification of the earlier order, saying:

- She could not afford a bank guarantee due to her poor financial condition.

- The confiscation proceeding had not been concluded even after three years.

- The vehicle’s value had fallen drastically to about ₹50,000.

State’s Stand

The State’s counsel, Mr. Pushkar Narain Shahi (AAG-6), did not dispute the delay or the fact that the vehicle was lying unused for years under the open sky. However, he submitted that the confiscation proceeding was still pending, and the Court should ensure protection of the State’s interest while granting any relief.

Court’s Observations

The High Court took note of the peculiar circumstances of the case and made several important observations of general application:

- Keeping Seized Vehicles in Police Stations Is Counterproductive

The Court observed that “keeping the vehicle for long periods under the open sky benefits neither the State nor the individual.” Vehicles left in police custody deteriorate, occupy scarce space, and eventually become junk — causing a “national loss.” - Reference to Supreme Court Precedent

The Court relied on Sunderbhai Ambalal Desai v. State of Gujarat, (2002) 10 SCC 283, where the Supreme Court had directed Magistrates to release seized vehicles on bonds and guarantees rather than letting them rot. It quoted paragraphs 15–17 of that case, emphasizing that: “It is of no use to keep seized vehicles at the police stations for a long period. Magistrates should pass appropriate orders immediately by taking bonds and security for return if required later.” - Prolonged Confiscation Proceedings

The Bench criticized the fact that confiscation proceedings were pending for over three years, noting that during such long delays, vehicles inevitably lose their roadworthiness. - Balancing Public and Private Interest

The Court sought to protect both — the petitioner’s right to property and the State’s interest in ensuring that seized assets are not misused.

Modified Directions by the Court

The earlier order requiring a bank guarantee was modified. The Court issued fresh directions to the District Magistrate, Saharsa (Confiscating Authority) as follows:

- The MVI, Saharsa shall re-assess the vehicle’s current valuation within seven days and submit the report with photographs to the Confiscating Authority.

- The petitioner shall furnish a surety bond equivalent to the value assessed by the MVI (instead of a bank guarantee).

- On furnishing this surety, the vehicle shall be provisionally released in favor of the petitioner.

- The petitioner shall also file an undertaking that:

- She will not create any third-party interest or transfer the vehicle during the pendency of the confiscation proceeding.

- She will produce the vehicle whenever required.

- A photograph of the vehicle will be kept on record, certified by the petitioner, to serve as secondary evidence if needed during trial.

With these modifications, the earlier judgment dated 18.12.2018 stood modified accordingly.

Significance or Implication of the Judgment

This ruling has far-reaching implications for confiscation proceedings under the Bihar Prohibition and Excise Act and similar cases across India.

- The Court reiterated that seized vehicles should not lie idle for years, as it serves no practical purpose and causes economic loss.

- It reaffirmed that Magistrates and Confiscating Authorities must follow the Sunderbhai Ambalal Desai principle and release seized vehicles promptly with suitable undertakings.

- It provides relief to poor vehicle owners who cannot afford bank guarantees, allowing them to use surety bonds instead.

- The judgment reflects a humane and balanced approach, recognizing the financial condition of the petitioner and the need to prevent wastage of seized assets.

For the general public and law enforcement, this decision serves as a reminder of procedural fairness — ensuring that property seized under the Excise Act is managed responsibly and efficiently.

Legal Issue(s) Decided and the Court’s Decision

- Whether the earlier condition of providing a bank guarantee was justified when the vehicle’s valuation was uncertain and the petitioner was poor?

➤ Decision: No. The Court modified the order, allowing release on a surety bond instead. - Whether keeping vehicles in police custody for years serves any purpose?

➤ Decision: No. The Court emphasized that such prolonged custody causes loss to both the State and the individual. - Whether release of seized vehicles pending confiscation violates the Excise Act?

➤ Decision: No. The release is provisional and subject to production when required; thus, it does not prejudice the confiscation process.

Judgments Relied Upon or Cited by the Court

- Sunderbhai Ambalal Desai v. State of Gujarat, (2002) 10 SCC 283

Case Title

Shanti Devi v. The State of Bihar & Ors.

Case Number

Civil Review No. 397 of 2019 in CWJC No. 12014 of 2018

Citation(s)

2021(2) PLJR 859

Coram and Names of Judges

Hon’ble the Chief Justice Sanjay Karol

Hon’ble Mr. Justice Rajeev Ranjan Prasad

Names of Advocates and who they appeared for

Mr. Shashank Shekhar Jha — for the petitioner

Mr. Pushkar Narain Shahi, AAG-6 — for the State

Link to Judgment

MTEjMzk3IzIwMTkjMyNO-M–ak1—-am1–FPMm9bes=

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.