Simplified Explanation of the Judgment

The Patna High Court has set aside three separate orders issued by the Assistant Commissioner of State Tax against a warehouse operator who had claimed Input Tax Credit (ITC) on the construction and equipment of its warehouse. The court has directed the tax authority to reconsider the matter after giving the taxpayer a proper hearing and evaluating whether the warehouse qualifies as “plant or machinery” under the Bihar Goods and Services Tax Act, 2017 (BGST Act).

Background

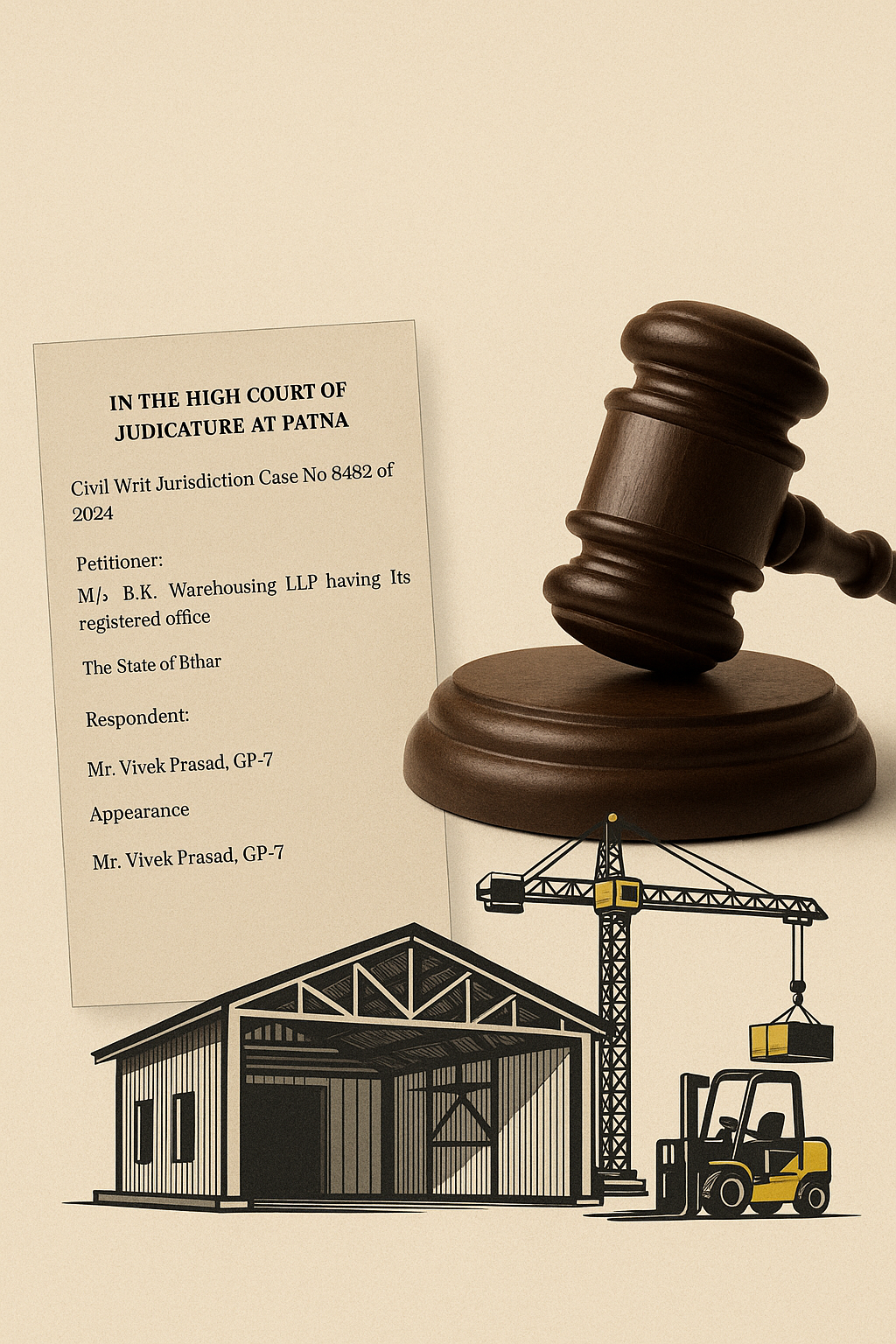

The petitioner had constructed a warehouse using both brick-and-mortar and pre-fabricated structures, along with equipment such as cranes, lifters, air conditioners, and generators. The warehouse was rented to companies dealing in consumable goods and e-marketing. The petitioner claimed ITC on expenses incurred for the construction and purchase of related equipment, asserting that the rental income was subject to GST and therefore ITC was allowable.

However, the tax department viewed the warehouse as an “immovable property” not qualifying for ITC under Section 17(5)(d) of the BGST Act, which generally bars ITC on construction of immovable property other than “plant or machinery.” Based on this interpretation, the Assistant Commissioner issued three separate orders demanding repayment of ITC:

- ₹59,810 for FY 2021–22

- ₹23,45,996 for April–July 2023

- ₹4,81,65,483 for FY 2022–23

Petitioner’s Argument

The petitioner argued that the matter was directly connected to the principles laid down in the case M/s Safari Retreats Pvt. Ltd. v. Chief Commissioner of Central GST, first decided by the Orissa High Court and later considered by the Supreme Court. The Supreme Court had clarified that whether a warehouse qualifies as “plant” is a factual question dependent on the business activities and the role of the structure. If the building is essential for providing taxable services, such as leasing, it could qualify for ITC. The petitioner contended that the Assistant Commissioner should have awaited the Supreme Court’s verdict before making a final decision.

State’s Argument

The State submitted that the petitioner had multiple chances to submit evidence but failed to do so. Moreover, the petitioner’s representative had earlier agreed—on record—to reverse ITC claims on civil construction materials permanently and on pre-fabricated materials temporarily, but did not follow through.

Court’s Findings

The High Court found that the Assistant Commissioner had not examined the key factual question: whether the warehouse could be classified as “plant or machinery” in line with the Supreme Court’s interpretation. Instead, the decision relied heavily on the earlier concession by the petitioner’s representative. The court emphasized that the functionality test laid down in the Safari Retreats decision must be applied to determine whether ITC is allowable.

Outcome

The court set aside all three impugned orders and directed the petitioner to appear before the Assistant Commissioner by April 7, 2025, with supporting documents. The tax authority must provide a fair hearing and pass a fresh, reasoned order within three months.

Significance or Implication of the Judgment

This judgment is significant because it reaffirms that the eligibility for ITC on construction of buildings like warehouses must be assessed using the “functionality test” established by the Supreme Court. It clarifies that blanket denial of ITC for immovable properties is not appropriate without first considering whether the structure plays an integral role in providing taxable services.

For businesses, especially those engaged in leasing or renting commercial properties, the decision opens the door to possible ITC claims if they can demonstrate that the construction is essential for their taxable activities. For tax authorities, it serves as a reminder to base decisions on factual assessments rather than solely on statutory prohibitions.

Legal Issue(s) Decided and the Court’s Decision with Reasoning

- Whether the Assistant Commissioner erred by not applying the functionality test before denying ITC

- Decision: Yes. The court held that the authority should have determined if the warehouse could be classified as “plant or machinery” in light of the Supreme Court’s ruling.

- Whether prior concessions by a representative can override a factual legal determination

- Decision: No. The court found that even if the petitioner’s representative had agreed to reverse ITC, the tax authority was still obligated to decide the matter on merits.

- Appropriateness of setting aside the impugned orders

- Decision: Yes. All three orders were set aside, and the matter was remanded for fresh consideration with proper opportunity for the petitioner to present evidence.

Judgments Referred by Parties

- M/s Safari Retreats Pvt. Ltd. & Another v. Chief Commissioner of Central GST & Others, W.P.(C) No. 20463 of 2018, Orissa High Court.

Judgments Relied Upon or Cited by Court

- Chief Commissioner of Central GST & Ors. v. M/s Safari Retreats Pvt. Ltd. & Ors., [2024] 131 GSTR 184 (SC).

Case Title

M/s B.K. Warehousing LLP v. The State of Bihar & Others

Case Number

- Civil Writ Jurisdiction Case No. 8482 of 2024

- Civil Writ Jurisdiction Case No. 9107 of 2024

- Civil Writ Jurisdiction Case No. 9122 of 2024

Coram and Names of Judges

Hon’ble Mr. Justice Rajeev Ranjan Prasad

Hon’ble Mr. Justice Sourendra Pandey

Names of Advocates and who they appeared for

- For the Petitioner: Mr. Saket Tiwary, Mr. Shivam Gupta, Mr. Animesh Gupta, Mr. Tarun

- For the Respondents: Mr. Vivek Prasad (GP-7), Ms. Roona (AC to GP-7), Mr. Sanjay Kumar (AC to GP-7), Standing Counsel (11)

Link to Judgment

b577c383-672d-402c-95db-9b8babe09fc8.pdf

If you found this explanation helpful and wish to stay informed about how legal developments may affect your rights in Bihar, you may consider following Samvida Law Associates for more updates.